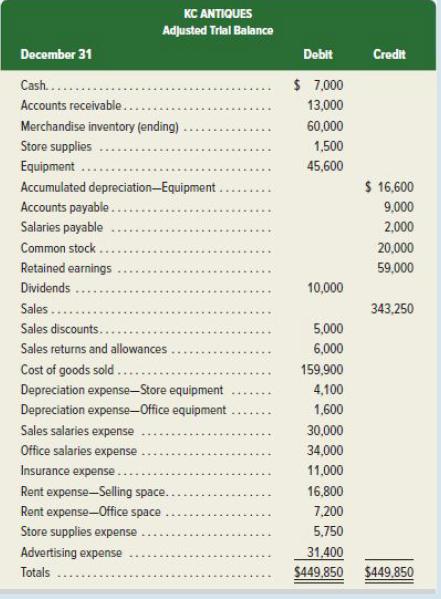

Use the following adjusted trial balance and additional information to complete the requirements. Supplementary records for the

Question:

Use the following adjusted trial balance and additional information to complete the requirements.

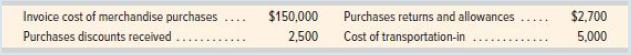

Supplementary records for the year reveal the following itemized costs for merchandising activities.

Required

1. Use the supplementary records to compute the total cost of merchandise purchases for the year.

2. Prepare a multiple-step income statement for the year. (Beginning inventory was $70,100.)

3. Prepare a single-step income statement for the year.

4. Prepare closing entries for KC Antiques at December 31.

5. Compute the acid-test ratio and the gross margin ratio. Explain the meaning of each ratio and interpret them for KC Antiques.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: