Given the most likely operating profit is 50 million, which financing option in Example 2.5 above would

Question:

Given the most likely operating profit is £50 million, which financing option in Example 2.5 above would you choose and why?

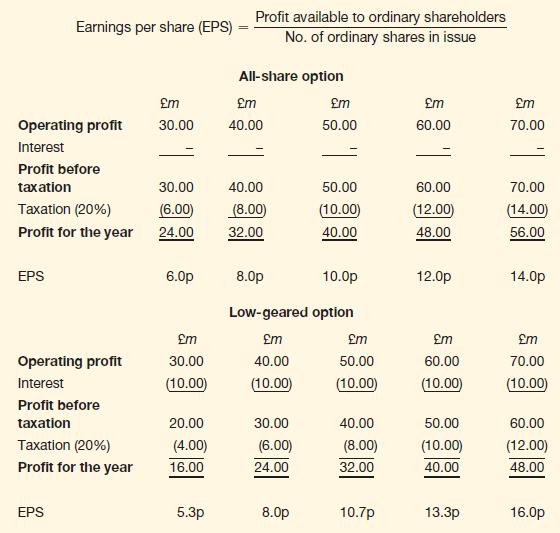

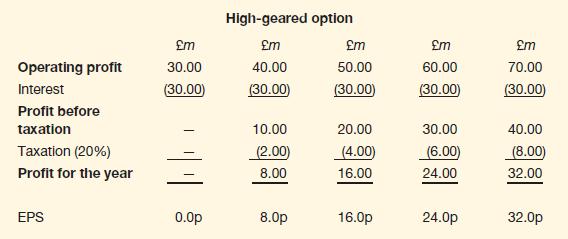

Example 2.5

Hidalgo plc has recently been formed to manufacture washing machines. The new business

will require £400 million in long-term finance and the directors are currently deciding

how to raise the funds required. Three options are being considered:

■ all £400 million from £1 ordinary shares (the ‘all-share option’); or

■ £300 million from £1 ordinary shares and £100 million from the issue of secured loan

notes paying interest at 10 per cent a year (the ‘low-geared option’); or

■ £100 million from £1 ordinary shares and £300 million from the issue of secured loan

notes paying interest at 10 per cent a year (the ‘high-geared option’).

Operating profit (that is, profit before interest and taxation) is expected to fall within the

range of £30 million to £70 million per year. However, the most likely figure is £50 million

per year. The rate of corporation tax is 20 per cent.

To evaluate the three options, we can calculate future returns to ordinary shareholders over

the range of possible operating profits. These will be measured using the following formula:

Step by Step Answer: