Helena Chocolate Products Ltd is considering the introduction of a new chocolate bar into its range of

Question:

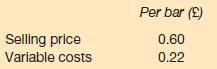

Helena Chocolate Products Ltd is considering the introduction of a new chocolate bar into its range of chocolate products. The new chocolate bar will require the purchase of a new piece of equipment costing £30,000 which will have no other use and no residual value on completion of the project. Financial data relating to the new product are as follows:

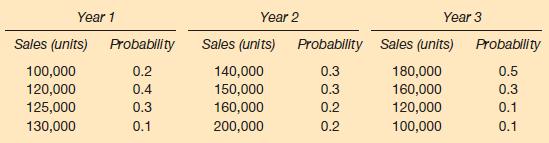

Fixed costs of £20,000 a year will be apportioned to the new product. These costs represent a ‘fair share’ of the total fixed costs of the business. The costs are unlikely to change as a result of any decision to introduce new products into the existing range. Other developments currently being finalised will mean that the new product will have a life of only three years and the level of expected demand for the new product is uncertain. The marketing department has produced the following levels of demand and the probability of each for all three years of the product’s life.

A rival business has offered to buy the right to produce and sell the new chocolate bar for £100,000. The cost of capital is 10 per cent and interest charges on the money borrowed to finance the project are expected to be £3,000 per year.

Required:

(a) Compute the expected net present value of the product.

(b) Advise the directors on the appropriate course of action. Give reasons.

Step by Step Answer: