Ixus plc is a large sugar-refining business that is currently considering the takeover of Decet plc, an

Question:

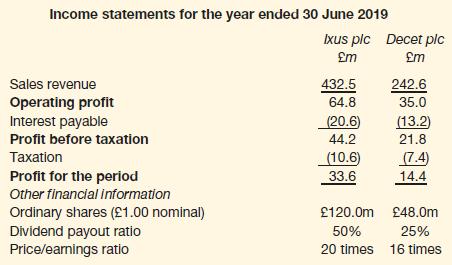

Ixus plc is a large sugar-refining business that is currently considering the takeover of Decet plc, an engineering business. Financial information concerning each business is as follows:

The board of directors of Ixus plc has offered shareholders of Decet plc 5 shares in Ixus plc for every 4 shares held. If the takeover is successful, the price/earnings ratio of the enlarged business is expected to be 19 times. The dividend payout ratio will remain unchanged. As a result of the takeover, after-tax savings in head office costs of £9.6 million per year are expected.

Required:

(a) Calculate:

(i) the total value of the proposed bid

(ii) the expected earnings per share and share price of Ixus plc following the takeover.

(b) Evaluate the proposed takeover from the viewpoint of an investor holding 20,000 shares in:

(i) Ixus plc

(ii) Decet plc.

Step by Step Answer: