Recommend a solution for Unicorn Engineering Ltd in Example5.1 above if the investment projects were not divisible

Question:

Recommend a solution for Unicorn Engineering Ltd in Example5.1 above if the investment projects were not divisible (that is, it was not possible to undertake part of a project).

Assume the finance available was:

(a) £12 million

(b) £18 million

(c) £20 million.

Data from Example5.1

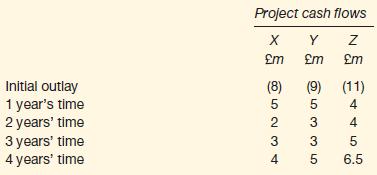

Unicorn Engineering Ltd is considering three possible investment projects: X, Y and Z. The expected pattern of cash flows for each project is as follows:

The business has a cost of capital of 12 per cent and the investment budget for the year that has just begun is restricted to £12 million. Each project is divisible (that is, it is possible to undertake part of a project if required).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: