Semplice Ltd manufactures catering equipment for restaurants and hotels. The statement of financial position of the business

Question:

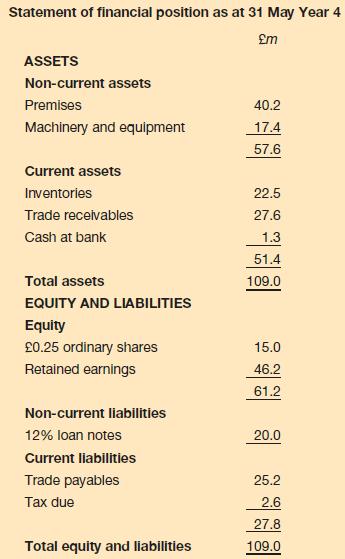

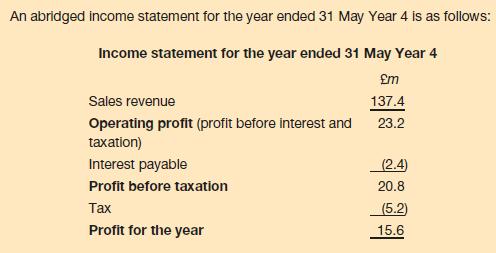

Semplice Ltd manufactures catering equipment for restaurants and hotels. The statement of financial position of the business as at 31 May Year 4 is as follows:

The board of directors of Semplice Ltd has decided to invest £20 million in new machinery and equipment to meet an expected increase in sales for the business’s products. The expansion in production facilities is expected to result in an increase of £6 million in annual operating profit (profit before interest and taxation).

1 To finance the proposed investment, the board of directors is considering either (i) a rights issue of eight million ordinary shares at a premium of £2.25 per share, or (ii) the issue of £20 million 10 per cent loan notes at nominal value.

2 A dividend of £6.0 million was proposed and paid during the year.

3 The directors wish to increase the dividend per share by 10 per cent in the forthcoming year irrespective of the financing method chosen.

Assume a tax rate of 25 per cent.

Required:

(a) Prepare a projected income statement (in abbreviated form) for the year to 31 May Year 5 under each financing option.

(b) Show the projected long-term capital structure of the business under each financing option as at 31 May Year 5.

(c) Using the information in your answer to

(a) and

(b) above, compute the earnings per share and degree of financial gearing for each financing option.

(d) Briefly evaluate the two financing options under consideration.

Step by Step Answer: