Stocks A and B have the following historical returns: a. Calculate the average rate of return for

Question:

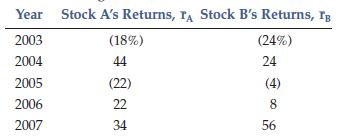

Stocks A and B have the following historical returns:

a. Calculate the average rate of return for each stock during the 5-year period.

Assume that someone held a portfolio consisting of 50% of Stock A and 50% of Stock B. What would have been the realized rate of return on the portfolio in each year? What would have been the average return on the portfolio during this period?

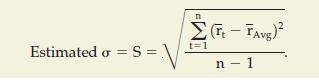

b. Now calculate the standard deviation of returns for each stock and for the portfolio. Use Equation 6-5.

Equation 6-5

c. Looking at the annual returns data on the two stocks, would you guess that the correlation coefficient between returns on the two stocks is closer to 0.8 or to –0.8?

c. Looking at the annual returns data on the two stocks, would you guess that the correlation coefficient between returns on the two stocks is closer to 0.8 or to –0.8?

d. If you added more stocks at random to the portfolio, which of the following is the most accurate statement of what would happen to σp?

(1) σp would remain constant.

(2) σp would decline to somewhere in the vicinity of 20%.

(3) σp would decline to zero if enough stocks were included.

Step by Step Answer:

Financial Management Theory & Practice

ISBN: 9780324652178

12th Edition

Authors: Eugene BrighamMichael Ehrhardt