Suppose that Merton plc (see Example9.1) replaces the 30m paid out as dividends by an issue of

Question:

Suppose that Merton plc (see Example9.1) replaces the £30m paid out as dividends by an issue of shares to new shareholders. Show the statement of financial position after the new issue and calculate the value of shares held by existing shareholders after the issue.

Data from Example9.1

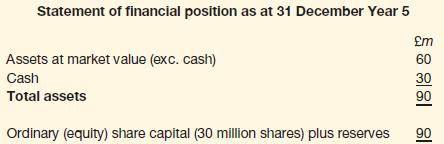

Merton plc has the following statement of financial position as at 31 December Year 5:

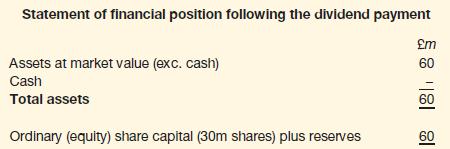

Suppose that the business decides to distribute all the cash available (that is, £30m to shareholders by making a 100p dividend per share. This will result in a fall in the value of assets to £60m (that is, £90m – £30m) and a fall in the value of each share from £3 (that is, £90m/30m) to £2 (that is, £60m/30m). The statement of financial position following the dividend payment will therefore be as follows:

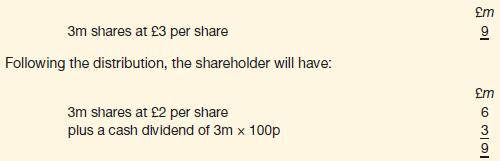

Before the dividend distribution, a shareholder holding 10 per cent of the shares in Merton plc will have:

In other words, the total wealth of the shareholder remains the same. If the shareholder did not want to receive the dividends, the cash received could be used to purchase more shares in the business. Although the number of shares held by the shareholder will change as a result of this decision, his or her total wealth will remain the same. If, however, Merton plc did not issue a dividend and the shareholder wished to receive one, he or she could create the desired dividend by simply selling a portion of the shares held. Once again, this will change the number of shares held by the shareholder but will not change the total amount of wealth held.

Step by Step Answer: