The board of directors of Wicklow plc is considering an expansion of production capacity following an increase

Question:

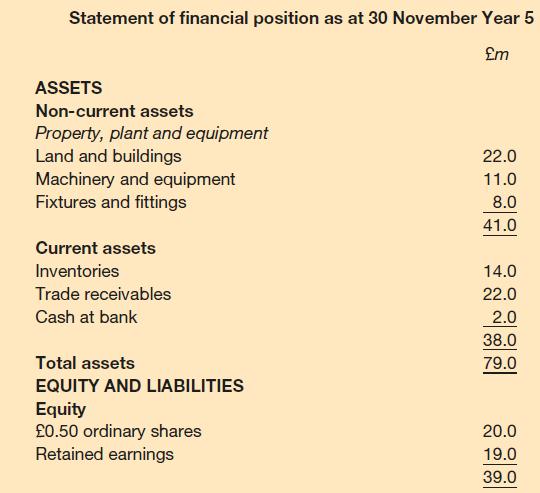

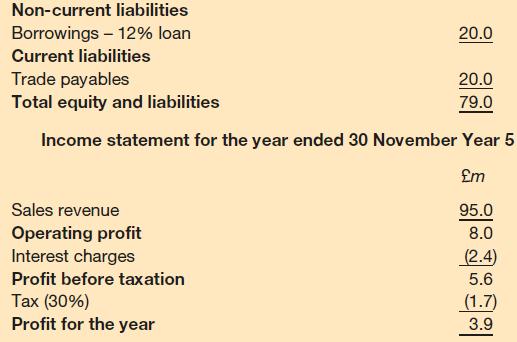

The board of directors of Wicklow plc is considering an expansion of production capacity following an increase in sales over the past two years. The most recent financial statements for the business are set out below.

A dividend of £1.2 million was proposed and paid during the year.

The business plans to invest a further £15 million in machinery and equipment and is considering two possible financing options. The first option is to make a one-for-four rights issue. The current market price per share is £2.00 and the rights shares would be issued at a discount of 25 per cent on this market price. The second option is to take a further loan that will have an initial annual rate of interest of 10 per cent. This is a variable rate and while interest rates have been stable for a number of years, there has been speculation recently that interest rates will begin to rise in the near future.

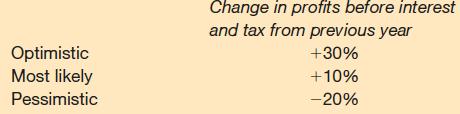

The outcome of the expansion is not certain. The management team involved in developing and implementing the expansion plans has provided three possible outcomes concerning operating profit (profit before interest and tax) for the following year:

The dividend per share for the forthcoming year is expected to remain the same as for the year ended 30 November Year 5.

Wicklow plc has a lower level of gearing than most of its competitors. This has been in accordance with the wishes of the Wicklow family, which has a large shareholding in the business. The share price of the business has shown rapid growth in recent years and the P/E ratio for the business is 20.4 times, which is much higher than the industry average of 14.3 times.

Costs of raising finance should be ignored.

Required:

(a) Prepare calculations that show the effect of each of the possible outcomes of the expansion programme on:

(i) earnings per share

(ii) the gearing ratio (based on year-end figures), and

(iii) the interest cover ratio of Wicklow plc, under both of the financing options.

(b) Assess each of the financing options available to Wicklow plc from the point of view of an existing shareholder and compare the possible future outcomes with the existing situation.

Step by Step Answer: