The Booth Companys sales are forecasted to increase from $1,000 in 2007 to $2,000 in 2008. Here

Question:

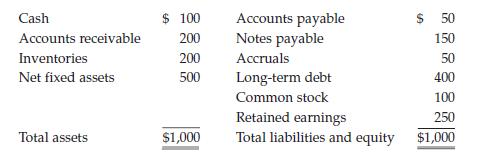

The Booth Company’s sales are forecasted to increase from $1,000 in 2007 to $2,000 in 2008. Here is the December 31, 2007, balance sheet:

Booth’s fixed assets were used to only 50% of capacity during 2007, but its current assets were at their proper levels. All assets except fixed assets increase at the same rate as sales, and fixed assets would also increase at the same rate if the current excess capacity did not exist. Booth’s after-tax profit margin is forecasted to be 5%, and its payout ratio will be 60%. What is Booth’s additional funds needed (AFN) for the coming year?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Management Theory & Practice

ISBN: 9780324652178

12th Edition

Authors: Eugene BrighamMichael Ehrhardt

Question Posted: