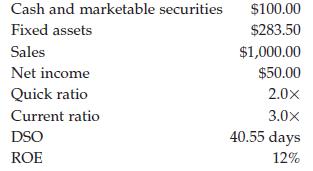

The following data apply to Jacobus and Associates (millions of dollars): Jacobus has no preferred stockonly common

Question:

The following data apply to Jacobus and Associates (millions of dollars):

Jacobus has no preferred stock—only common equity, current liabilities, and longterm debt.

a. Find Jacobus’s (1) accounts receivable (A/R), (2) current liabilities, (3) current assets, (4) total assets, (5) ROA, (6) common equity, and (7) long-term debt.

b. In part a, you should have found Jacobus’s accounts receivable (A/R) $111.1 million. If Jacobus could reduce its DSO from 40.55 days to 30.4 days while holding other things constant, how much cash would it generate? If this cash were used to buy back common stock (at book value), thus reducing the amount of common equity, how would this affect (1) the ROE, (2) the ROA, and (3) the total debt/total assets ratio?

Step by Step Answer:

Financial Management Theory & Practice

ISBN: 9780324652178

12th Edition

Authors: Eugene BrighamMichael Ehrhardt