What is the shareholder value figure for the business in Example 11.2? Would the sale of the

Question:

What is the shareholder value figure for the business in Example 11.2? Would the sale of the shares at £11 per share really add value for the shareholders of Bortex plc?

Example 11.2

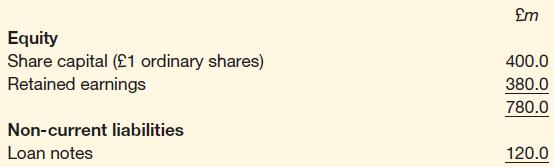

The directors of United Pharmaceuticals plc are considering the purchase of all the shares in Bortex plc, which produces vitamins and health foods. Bortex plc has a strong presence in the UK and it is expected that the directors of the business will reject any bids that value the shares of the business at less than £11.00 per share. Bortex plc generated sales for the most recent year of £3,000 million. Extracts from the statement of financial position of the business at the end of the most recent year are as follows:

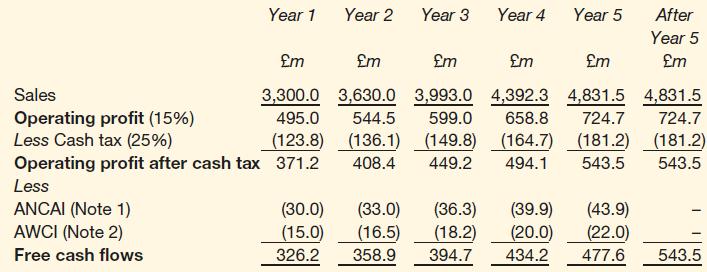

Forecasts that have been prepared by the business planning department of Bortex plc are as follows:

■ Sales revenue will grow at 10 per cent a year for the next five years.

■ The operating profit margin is currently 15 per cent and is likely to be maintained at this rate in the future.

■ The cash tax rate is 25 per cent.

■ Replacement non-current asset investment (RNCAI) will be in line with the annual depreciation charge each year.

■ Additional non-current asset investment (ANCAI) over the next five years will be 10 per cent of sales growth.

■ Additional working capital investment (AWCI) over the next five years will be 5 per cent of sales growth.

After five years, the sales of the business will stabilise at their Year 5 level.

The business has a cost of capital of 10 per cent and the loan notes figure in the statement of financial position reflects their current market value.

The free cash flow calculation will be as follows:

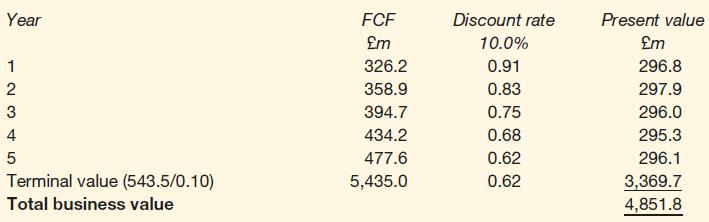

Having derived the free cash flows (FCF), we can calculate the total business value as follows:

Step by Step Answer: