Consider the project contained in problem 14.7 in chapter 14. a. Perform a sensitivity analysis to see

Question:

Consider the project contained in problem 14.7 in chapter 14.

a. Perform a sensitivity analysis to see how NPV is affected by changes in the number of procedures per day, average collection amount, and salvage value.

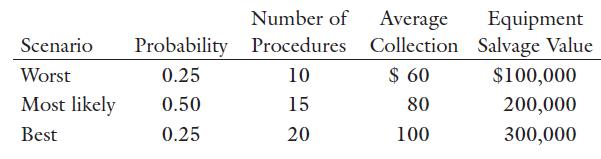

b. Conduct a scenario analysis. Suppose that the hospital’s staff concluded that the three most uncertain variables were number of procedures per day, average collection amount, and the equipment’s salvage value. Furthermore, the following data were developed:

c. Finally, assume that California Health Clinic’s average project has a coefficient of variation of NPV in the range of 1.0–2.0.

The hospital adjusts for risk by adding or subtracting 3 percentage points to its 10 percent corporate cost of capital. After adjusting for differential risk, is the project still profitable?

d. What type of risk was measured and accounted for in parts b and c? Should this be of concern to the hospital’s managers?

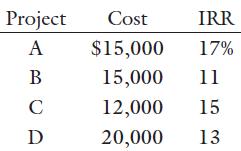

The managers of United Medtronics are evaluating the following four projects for the coming budget period. The firm’s corporate cost of capital is 14 percent.

e. What is the firm’s optimal capital budget?

f. Now, suppose Medtronics’s managers want to consider differential risk in the capital budgeting process. Project A has average risk, project B has below-average risk, project C has above-average risk, and project D has average risk. What is the firm’s optimal capital budget when differential risk is considered?

Problem 14.7

From a purely financial perspective, are there situations in which a business would be better off choosing a project with a shorter payback over one that has a larger NPV?

Step by Step Answer:

Gapenski's Healthcare Finance An Introduction To Accounting And Financial Management

ISBN: 9781640551862

7th Edition

Authors: Kristin L. Reiter, Paula H. Song