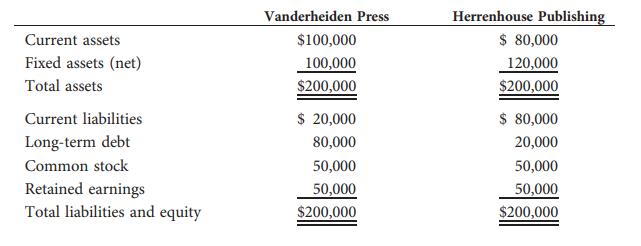

Vanderheiden Press Inc. and the Herrenhouse Publishing Company had the following balance sheets as of December 31,

Question:

Vanderheiden Press Inc. and the Herrenhouse Publishing Company had the following balance sheets as of December 31, 2013 (thousands of dollars):

Earnings before interest and taxes for both firms are $30 million, and the effective federalplus-state tax rate is 40%.

a. What is the return on equity for each firm if the interest rate on current liabilities is 10% and the rate on long-term debt is 13%?

b. Assume that the short-term rate rises to 20%, that the rate on new long-term debt rises to 16%, and that the rate on existing long-term debt remains unchanged. What would be the return on equity for Vanderheiden Press and Herrenhouse Publishing under these conditions?

c. Which company is in a riskier position? Why?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: