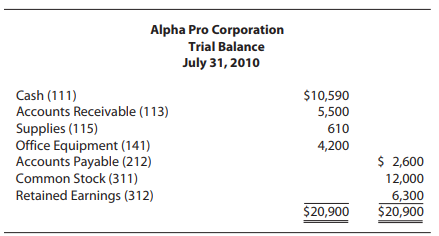

Alpha Pro Corporation is a marketing firm. The companys trial balance on July 31, 2010, appears below.

Question:

Alpha Pro Corporation is a marketing firm. The company’s trial balance on July 31, 2010, appears below.

During the month of August, the company completed the following transactions:

Aug. 2 Paid rent for August, $650.

3 Received cash from customers on account, $2,300.

7 Ordered supplies, $380.

10 Billed customers for services provided, $2,800.

12 Made a payment on accounts payable, $1,300.

14 Received the supplies ordered on August 7 and agreed to pay for them in 30 days, $380.

17 Discovered some of the supplies were not as ordered and returned them for full credit, $80.

19 Received cash from a customer for services provided, $4,800.

24 Paid the utility bill for August, $250.

26 Received a bill, to be paid in September, for advertisements placed in the local newspaper during the month of August to promote Alpha Pro Corporation, $700.

Aug. 29 Billed a customer for services provided, $2,700.

30 Paid salaries for August, $3,800.

31 Declared and paid a dividend of $1,200.

Required

1. Open accounts in the ledger for the accounts in the trial balance plus the following accounts: Dividends (313); Marketing Fees (411); Salaries Expense (511); Rent Expense (512); Utilities Expense (513); and Advertising Expense (515).

2. Enter the July 31, 2010, account balances from the trial balance.

3. Enter the above transactions in the general journal. 4. Post the journal entries to the ledger accounts. Be sure to make the appropriate posting references in the journal and ledger as you post.

5. Prepare a trial balance as of August 31, 2010.

6. Examine the transactions for August 3, 10, 19, and 29. How much were revenues and how much cash was received from the revenues? What business issues might you see arising from the differences in these numbers?

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Financial and Managerial Accounting

ISBN: 978-1439037805

9th edition

Authors: Belverd E. Needles, Marian Powers, Susan V. Crosson