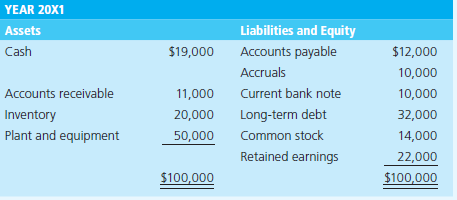

A firms balance sheets for the last two years are as follows: Sales in 20X1 were $250,000.

Question:

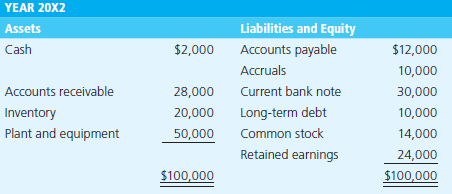

Sales in 20X1 were $250,000. Sales in 20X2 were $250,000.

a. Based solely on the current ratio and the quick ratio, has the firm€™s liquidity position deteriorated or improved?

b. Without doing a calculation, has days sales outstanding (receivables turnover) improved? How do you know?

c. Without doing a calculation, has inventory turnover deteriorated? How do you know?

d. If the firm earned $5,000 during 2012, what proportion of those earnings were distributed?

YEAR 20X1 Liabilities and Equity Assets Cash $19,000 Accounts payable $12,000 Accruals 10,000 Current bank note Accounts receivable 11,000 10,000 20,000 Long-term debt Inventory 32,000 Plant and equipment Common stock 50,000 14,000 Retained earnings 22,000 $100,000 $100,000 YEAR 20X2 Liabilities and Equity Assets Cash $2,000 Accounts payable $12,000 Accruals 10,000 Accounts receivable 28,000 Current bank note 30,000 Inventory 20,000 Long-term debt 10,000 Plant and equipment 50,000 Common stock 14,000 Retained earnings 24,000 $100,000 $100,000

Step by Step Answer:

In this problem sales are the same in both years This permits the student to draw conclu...View the full answer

Basic Finance An Introduction to Financial Institutions, Investments and Management

ISBN: 978-1285425795

11th Edition

Authors: Herbert B. Mayo

Related Video

Inventory turnover is a key metric that helps businesses evaluate the efficiency of their operations. A high turnover ratio is generally considered positive, indicating that the company is effectively selling its inventory and making efficient use of its resources. On the other hand, a low turnover ratio may indicate issues such as overstocking or slow sales and may require further examination to identify and address the underlying causes. Businesses use this ratio to make decisions about inventory levels, production schedules, and pricing strategies. It also helps businesses to identify areas where they may need to make improvements, such as reducing lead times for production or optimizing sales and marketing efforts. Additionally, inventory turnover is used by investors and analysts as a key performance indicator to evaluate the financial health and growth potential of a company.

Students also viewed these Business questions

-

a. Why are ratios useful? What are the five major categories of ratios? b. Calculate DLeons 2019 current and quick ratios based on the projected balance sheet and income statement data. What can you...

-

The financial statements of Big City News, Inc., include the following items: Requirements 1. Using Exhibit 13-8 as a model, compute the following ratios for 2014 and 2013: a. Current ratio b. Quick...

-

The financial statements of Family News, Inc., include the following items: Requirements 1. Compute the following ratios for 2012 and 2011: a. Current ratio b. Quick (acid test) ratio c. Inventory...

-

In Problems 2738, the reduced row echelon form of a system of linear equations is given. Write the system of equations corresponding to the given matrix. Use x, y; or x, y, z; or x 1 , x 2 , x 3 , x...

-

If the price of copper in Europe is 2.12 per ounce, what is the expected price of copper in the United States if the spot exchange rate is $1 = 0.7623?

-

Discuss how economic, global, and ethical environments interact with respect to an organization like Mercy Corps?

-

Suppose $X \sim N(0,1)$ and $W_{n} \sim \chi_{n}^{2}$ independently for any positive integer $n$. Let $V_{n}=X / \sqrt{W_{n}} / n$. a. We know $V_{n} \sim t_{n}$. Show that $V_{n}^{2}$ follows an...

-

Are there any levers that Kirsten can use to counteract the reason and rationalizations and persuade Matt about the right thing to do?

-

What are BMO's competitors doing, and how can BMO learn from them?

-

Please solve this problem using C language Hacker Industries has a number of employees. The company assigns each employee a numeric evaluation score and stores these scores in a list. A manager is...

-

A firm has no cash sales (all sales are on credit and are collected 36 days after the sale). If the receivables are $100,000, what is the level of sales? Based solely on given information, what can...

-

A firm with sales of $10,000,000 has inventory of $1,000,000. The firm has no cash sales (all sales are on credit and are collected within 40 days). You are willing to sell inventory to the firm on...

-

Right Bank offers EAR loans of 9.38% and requires a monthly payment on all loans. What is the APR for these monthly loans? What is the monthly payment for (a) a loan of $200,000 for six years, (b) a...

-

1-Discuss the concept of criminal intent as it relates to the enforcement of environmental laws 2- Discuss why one of the most important decisions the prosecutor makes is whether to pursue cases...

-

Write a detail note on How is NEPA different than other environmental laws ?

-

what are the five environmental laws? elaborate each

-

what is a current environmental law being debated on by politicians, business, and environmental organizations? who has the most to win and who has the most to lose if the law is passed?

-

how does the legal issue of personhood influence environmental law?

-

The battery in the circuit shown in Fig. Q26.14 has no internal resistance. After you close the switch S, will the brightness of bulb B 1 increase, decrease, or stay the same? Figure Q26.14 B1 B2

-

Provide a draft/outline of legal research involving an indigenous Canadian woman charged with assault causing bodily harm under (Sec 267b) of the Criminal Code, where the crown wants a 12-month jail...

-

Big Oil Inc. has a preferred stock outstanding that pays a $9 annual dividend. If investors required rate of return is 13 percent, what is the market value of the shares? If the required return...

-

What should be the prices of the following preferred stocks if comparable securities yield 7 percent? Why are the valuations different? a. MN Inc., $8 preferred ($100 par) b. CH Inc., $8 preferred...

-

What should be the prices of the following preferred stocks if comparable securities yield 7 percent? Why are the valuations different? a. MN Inc., $8 preferred ($100 par) b. CH Inc., $8 preferred...

-

Why are Incoterms 2020 and Terms of Payment considered an important factor in executing global trade contracts? and also provide five various examples and risk related risk factors,

-

What is the purpose of using the Loan Manager in QuickBooks?

-

What is typically not available for entry by an employee in an HRIS employee self-service application?

Study smarter with the SolutionInn App