a. Sing the most recent issue of The Wall Street Journal, review the yields for the following

Question:

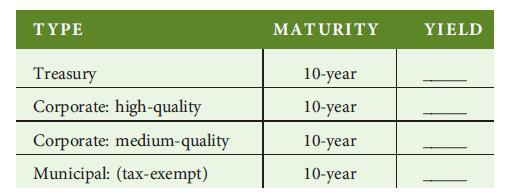

a. Sing the most recent issue of The Wall Street Journal, review the yields for the following securities:

If credit (default) risk is the only reason for the yield differentials, what is the default risk premium on the corporate high-quality bonds? On the medium-quality bonds? During a recent recession, high-quality corporate bonds offered a yield of 0.8 percent above Treasury bonds, and medium-quality bonds offered a yield of about 3.1 percent above Treasury bonds. How do these yield differentials compare to the differentials today?

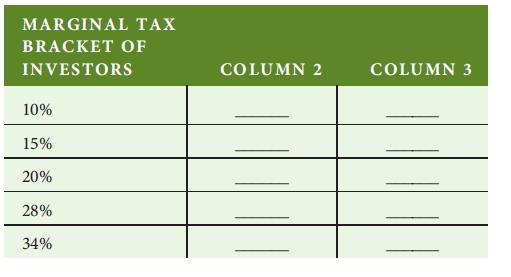

Explain the reason for the change in yield differentials. Using the information in the previous table, complete the table below. In Column 2, indicate the before-tax yield necessary to achieve the existing after-tax yield of tax-exempt bonds. In Column 3, answer this question: If the tax-exempt bonds have the same risk and other features as high-quality corporate bonds, which type of bond is preferable for investors in each tax bracket?

b. Using the most recent issue of The Wall Street Journal, review the corporate debt section showing the high-yield issue with the biggest price decrease.

• Why do you think there was such a large decrease in price?

• How does this decrease in price affect the expected yield for any investors who buy bonds now?

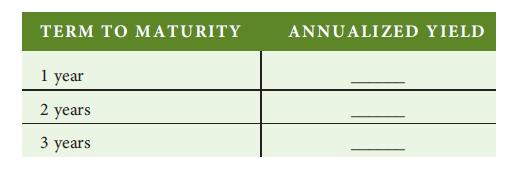

c. Using the most recent issue of The Wall Street Journal, review the yield curve to determine the approximate yields for the following maturities:

Assuming that the differences in these yields are solely because of interest rate expectations, determine the one-year forward rate as of one year from now and the one-year forward rate as of two years from now.

d. “Treasury Yield Curve.” Use this curve to describe the market’s expectations about future interest rates. If a liquidity premium exists, how would this affect your perception of the market’s expectations?

Step by Step Answer: