Amazon.com issued an initial public offering in May 1997. Prior to its IPO, the following information on

Question:

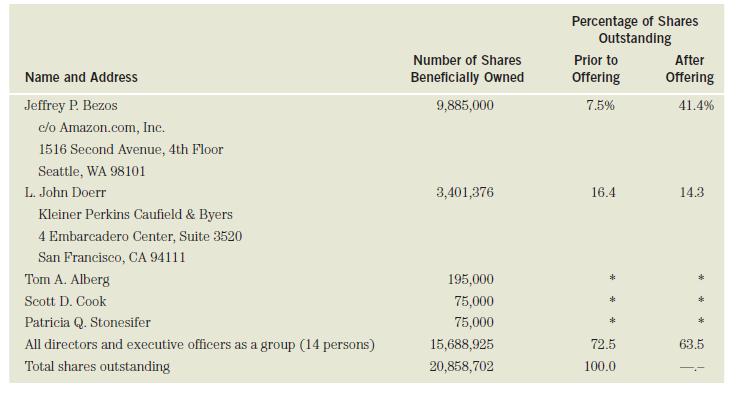

Amazon.com issued an initial public offering in May 1997. Prior to its IPO, the following information on shares outstanding was listed in the final prospectus:

In the IPO, the firm issued 3,000,000 new shares. The initial price was $18.00/share with investment bankers retaining $1.26 as fees. The final first-day closing price was $23.50.

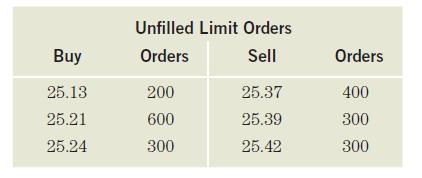

The limit-order book for a security is as follows:

The specialist receives the following, in order:

• Market order to sell 400 shares

• Limit order to buy 200 shares at 25.39

• Limit order to buy 600 shares at 25.31 How, if at all, are these orders filled? What does the limitorder book look like after these orders?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Markets And Institutions

ISBN: 9781292215006

9th Global Edition

Authors: Stanley Eakins Frederic Mishkin

Question Posted: