Consider the following cash flows. All market interest rates are 12%. a. What price would you pay

Question:

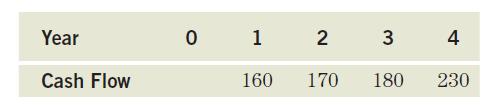

Consider the following cash flows. All market interest rates are 12%.

a. What price would you pay for these cash flows? What total wealth do you expect after 2.5 years if you sell the rights to the remaining cash flows? Assume interest rates remain constant.

b. Immediately after buying these cash flows, all market interest rates drop to 11%. What is the impact on your total wealth after 2.5 years?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Markets And Institutions

ISBN: 9781292215006

9th Global Edition

Authors: Stanley Eakins Frederic Mishkin

Question Posted: