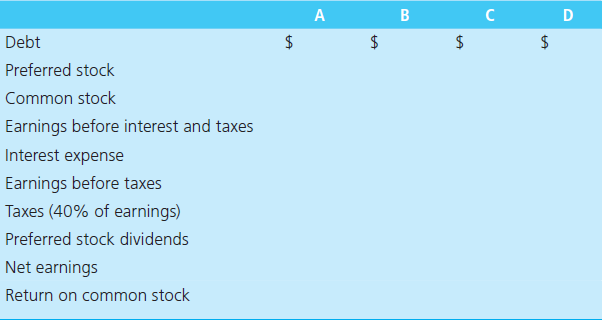

Fill in the table using the following information. Assets required for operation: $10,000 Firm A uses only

Question:

Assets required for operation: $10,000

Firm A uses only equity financing

Firm B uses 30% debt with a 6% interest rate and 70% equity

Firm C uses 50% debt with a 10% interest rate and 50% equity

Firm D uses 50% preferred stock financing with a dividend rate of 10% and 50% equity financing

Earnings before interest and taxes: $1,000

What happens to the common stockholders€™ return on equity as the amount of debt increases? Why is the rate of interest greater in case C? Why is the return lower when the firm uses preferred stock instead of debt? Why does the use of preferred stock involve less risk for the firm than a comparable use of debt financing?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Basic Finance An Introduction to Financial Institutions, Investments and Management

ISBN: 978-1285425795

11th Edition

Authors: Herbert B. Mayo

Question Posted: