Suppose that on January 18, 2022, a U.S. firm plans to purchase 3 million euros () worth

Question:

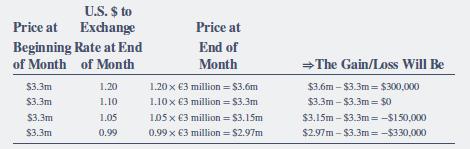

Suppose that on January 18, 2022, a U.S. firm plans to purchase 3 million euros’ (€) worth of French bonds from a French FI in one month’s time. The French FI wants payment in euros. Thus, the U.S. firm must convert dollars into euros. The spot exchange rate for January 18, 2022, of U.S. dollars for euros is 1.10, or one euro costs $1.10 in dollars. Consequently, the U.S. firm must convert:

U.S. $/€ exchange rate × €3 million = 1.10 × €3m. = $3, 300,000. into euros today. One month after the conversion of dollars to euros, the French bond purchase deal falls through and the U.S. firm no longer needs the euros it purchased at $1.10 per euro. Calculate the gain/loss on the bond to the U.S. firm if the spot exchange rate of U.S. dollars for euros is 1.20, 1.10, 1.05, and 0.99 at the end of the month.

Step by Step Answer:

Financial Markets And Institutions

ISBN: 9781264098729

8th Edition

Authors: Anthony Saunders, Marcia Cornett