a. Based on a yield to maturity of (12.5 %) for 10-year Treasury securities, demonstrate that the

Question:

a. Based on a yield to maturity of \(12.5 \%\) for 10-year Treasury securities, demonstrate that the price of a \(13 \%\) coupon, 10 -year Treasury would be \(\$ 102.8102\) per \(\$ 100\) par value if all cash flows are discounted at \(12.5 \%\).

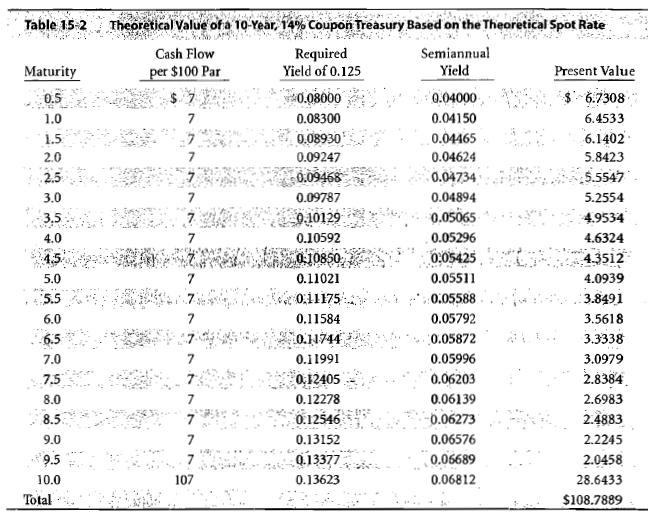

b. Based on the theoretical spot rates in Table 15-2, show that the theoretical value would be \(\$ 102.9304\) per \(\$ 100\) par value.

c. Explain why the market price for this Treasury security would trade close to its theoretical value.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations Of Financial Markets And Institutions

ISBN: 9780136135319

4th Edition

Authors: Frank J Fabozzi, Franco G Modigliani, Frank J Jones

Question Posted: