Consider a Bermudan-style Asian option, written on a non-dividendpaying stock, whose price, under the risk-neutral measure, follows

Question:

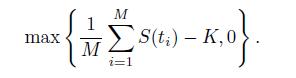

Consider a Bermudan-style Asian option, written on a non-dividendpaying stock, whose price, under the risk-neutral measure, follows the usual GBM process. The payoff is based on the arithmetic average of the prices at M time instants, ti = i T/M, i = 1; : : : ;M. At maturity , the payoff is

, the payoff is

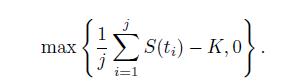

The option can only be exercised at the above time instants ti, after observing the current underlying asset price, based on which the average is updated. At time tj , the payoff is related to the average cumulated so far, i.e., the intrinsic value is

each time step.

Define the relevant control variable(s).

Write a dynamic programming recursive equation to define the value function at a generic time instant when the option can be exercised.

Note: You may consider pricing at time t = 0, just when the option is written.

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte