Let us assume that LIBOR rates for 6 and 12 months are 3% and (3.3 %), respectively,

Question:

Let us assume that LIBOR rates for 6 and 12 months are 3\% and \(3.3 \%\), respectively, with continuous compounding. We would like to find the LIBOR rate for 18 months, and we consider the quoted swap rate for a contract maturing in 18 months with semiannual payments. The quoted rates are

bid \(3.5 \% \quad\) ask \(3.7 \%\)

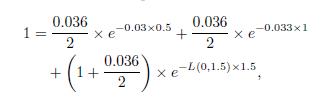

which reflect the bid-ask spreads observed in real-life markets (see Section 5.3.1). Let us take the average, \(3.6 \%\), as the swap rate. Note that these rates are to be considered as semiannually compounded and define cash flows, rather than discount factors. The swap rate is such that a fixed-coupon bond with coupon rate \(3.6 \%\), maturing in 18 months, trades at par. Assuming an arbitrary face value of \(\$ 1\), we have to solve the following equation:

which yields  with continuous compounding.

with continuous compounding.

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte