We want to find the price of a vanilla American-style put call with (S_{0}=60, K=70, r=002, quad=045),

Question:

We want to find the price of a vanilla American-style put call with \(S_{0}=60, K=70, r=002, \quad=045\), and \(T=1\), by using a three-step binomial lattice (each time step consists of four months).

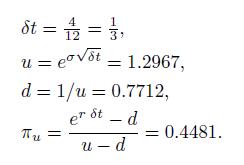

The lattice calibration is:

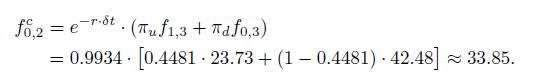

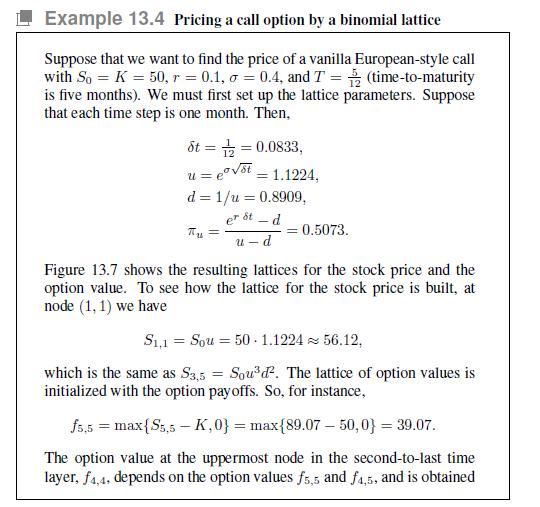

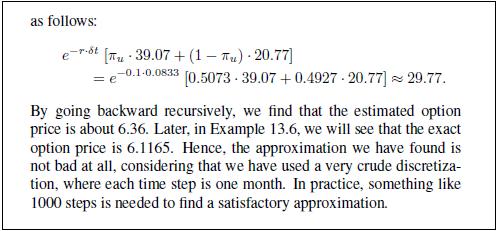

The discount factor at each step is \(e^{0.023}=0.\) 9934. Figure 13.8 shows the resulting lattices for the stock price and the option value. The stock price lattice is built like in Example 13.4, and the option price lattice is initialized by using the put option payoff (the option is in-the-money in the lower part of the lattice). The interesting node is (0,2 ), the shaded one, where the continuation value is

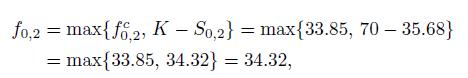

However, this should be checked against the intrinsic value:

from which we see that early exercise occurs at node {0,2}. As a consequence, the resulting option price is a bit larger than the price of the corresponding European-style put.

Data From Example 13.4

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte