Consider a portfolio of two stocks whose statistical parameters are given below. Stock A: Annual mean return

Question:

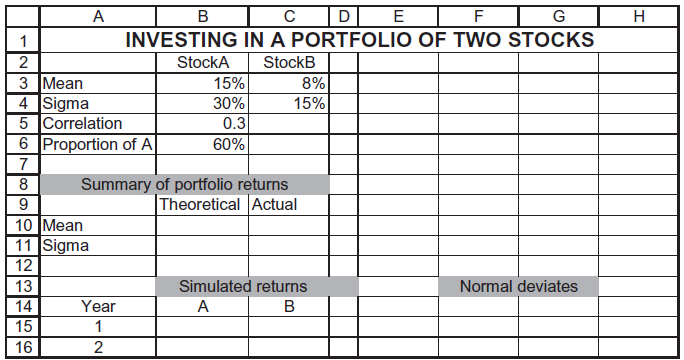

Consider a portfolio of two stocks whose statistical parameters are given below.

Stock A: Annual mean return = 15%, annual standard deviation of return = 30%.

Stock B: μ = 8%, σ= 15%.

Correlation(A,B) = ρ = 0.3

An investor with a buy-and-hold strategy buys a portfolio composed of 60% A and 40% B and holds it for 20 years. Simulate the annual returns on the portfolio. A suggested template is given below.

1 2 3 Mean 4 Sigma 5 Correlation 6 7 8 9 10 Mean 11 Sigma 12 13 14 15 56 A 16 Proportion of A B C D E F G INVESTING IN A PORTFOLIO OF TWO STOCKS StockA StockB Year 1 2 15% 30% 0.3 60% 8% 15% Summary of portfolio returns Theoretical Actual Simulated returns A B Normal deviates H

Step by Step Answer:

No significant indexed lists found Here is a reproduction of the yearly profits from the ...View the full answer

Related Video

Stocks (also known as equities) are securities that represent ownership in a company. They are issued by companies to raise capital, and when an individual buys stocks, they become a shareholder in that company. Investing in stocks can be a way for individuals to potentially earn a return on their investment through dividends and capital appreciation. However, investing in stocks also carries a level of risk, as the value of the stock can fluctuate based on various factors such as the financial performance of the company and general market conditions. For companies, issuing stocks can be a way to raise funds for growth and expansion. When a company goes public by issuing an initial public offering (IPO), it can raise significant capital by selling ownership stakes to the public. Companies can also issue additional stock offerings to raise additional capital as needed.

Students also viewed these Business questions

-

Consider a portfolio of two securities: one share of Johnson and Johnson (JNJ) stock and a bond that pays $100 in one year. Suppose this portfolio is currently trading with a bid price of $141.65 and...

-

Consider a portfolio of d=100 default able corporate bonds. We assume that the defaults of different bonds are independent. The default probability is identical for all bonds and is equal to 1.5%....

-

Consider a portfolio of options on a single asset. Suppose that the delta of the portfolio is 12, the value of the asset is $10, and the daily volatility of the asset is 2%. Estimate the one-day 95%...

-

please help with the entire question asap please thank you!! 12. ABC Manufacturing Company has the following data for 2024 (amounts in millions): EIE (Cick the icon to viow the information.) Prepare...

-

A client invested 100 at the start of the month. Assume that the manager tracks an assigned benchmark index. After 20 days, the portfolio gained 10 percent (value = 110), as did the index, and the...

-

Describe the five drivers of globalization.

-

Why is it necessary to create time-phased budgets in projects? What are their major strengths?

-

A quality control inspector at the Beautiful Shampoo Company has taken three samples with four observations each of the volume of shampoo bottles filled. The data collected by the inspector and the...

-

You need to accumulate $10,000. To do so, you plan to make deposits of $1,400 per year - with the first payment being made a year from today - into a bank account that pays 7% annual interest. Your...

-

Rex and Felix are the sole shareholders of Dogs and Cats Corporation (DCC). After several years ofoperations using the accrual method, they decided to liquidate the corporation and operate...

-

Run a few of the lognormal price path simulations. Examine the price pattern for trends. Find one or more of the following technical patterns:support arearesistance areauptrend/downtrendhead and...

-

The previous example assumes that the risk-free rate is constant. An alternative, perhaps more plausible, model might be to assume that the risk-free rate is mean reverting, with a long-run mean....

-

A ________ is used to identify the impact on an organization if a risk occurs.

-

Discuss the criminal trial process.

-

Explain the elements of a contract.

-

Discuss the distinctions among negligent torts, intentional torts, and strict liability.

-

Describe the differences between an express and an implied contract.

-

Discuss the pretrial discovery process.

-

The current liabilities section of the December 31, 2013, balance sheet of Learnstream Company included notes payable of $14,000 and interest payable of $490. The note payable was issued to Tanner...

-

Reduction in sales All of the above 29. Belt of an electric motor is broken, it needs a. Corrective maintenance b. Scheduled maintenance c. Preventive maintenance d. Timely maintenance. 30. The...

-

How do the systems described in this case improve farming operations?

-

How do precision agriculture systems support decision making? Identify three different decisions that can be supported.

-

How helpful is precision agriculture to individual farmers and the agricultural industry? Explain your answer.

-

KINDLY HELP ME WITH GOOD EXAMPLES OF EACH OF THE THREE FORMS OF MARKET EFFICIENCY TO BACK THE INFORMATION BELOW The three forms of market efficiency and an assessment of their plausibility First of...

-

Aladdin's Lamp Oil Company produces both A-1 Fancy and B Grade Oil. There are approximately $90,000 in joint costs that Filch may allocate using the sales value at the split-off point approach or the...

-

http://freakonomics.com/podcast/why-bad-environmentalism-is-such-an-easy-sell-a-new-freakonomics-radio-podcast-2/ PART 1 Freakonomics: Why Bad Environmentalism Is Such An Easy Sell In this section,...

Study smarter with the SolutionInn App