Consider the case of five possible rating states, A, B, C, D, and E. A, B, and

Question:

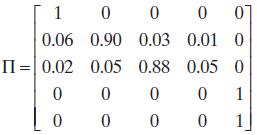

Consider the case of five possible rating states, A, B, C, D, and E. A, B, and C are initial bond ratings, D symbolizes first-time default, and E indicates default in the previous period. Assume that the transition matrix ? is:

A 10-year bond issued today at par with an A rating is assumed to bear a coupon rate of 7%.

? If a bond is issued today at par with a B rating and with a recovery percentage of 50%, what should be its coupon rate so that its expected return will also be 7%?

? If a bond is issued today at par with a C rating and with a recovery percentage of 50%, what should be its coupon rate so that its expected return will be 7%?

1 0 0 0.06 0.90 0.03 0.01 0 II=| 0.02 0.05 0.88 0.05 0 1

Step by Step Answer:

To answer these questions we will use the formula for calculating the expected return on a bond Expected return Coupon payment Par value Market price ...View the full answer

Related Video

Bond valuation is the process of determining the worth of a bond. It is based on the present value of the bond\'s future cash flows, which include coupon payments and the return of the bond\'s face value (or \"principal\") at maturity. The discount rate used in the calculation is directly tied to prevailing interest rates, and a rise in interest rates will decrease the present value of the bond and thus lower its price. Conversely, a fall in interest rates will increase the present value of the bond and raise its price. Interest rates serve as a benchmark for determining the value of a bond, as they determine the discount rate used in the bond valuation calculation. The most commonly used measure of interest rates is the yield to maturity (YTM), which represents the internal rate of return of an investment in a bond if the investor holds the bond until maturity and receives all scheduled payments. Yield to maturity is a function of the coupon rate, the current market price of the bond, the face value of the bond, and the number of years remaining until maturity. By comparing the yield to maturity of a bond to prevailing market interest rates, an investor can assess the relative value of the bond.

Students also viewed these Business questions

-

Consider the case of a positive consumption externality. A. Suppose throughout this exercise that demand and supply curves are linear, that demand curves are equal to marginal willingness to pay...

-

Consider the case of the two masses connected as shown in Figure E3.15. The sliding friction of each mass has the constant b. Determine a state variable matrix differential equation. Sliding friction...

-

Consider the case of a coffee mug being produced by rapid prototyping. Describe how the top of the handle can be manufactured, since there is no material directly beneath the arch of the handle?

-

5 Melbourne Corporation has traditionally made a subcomponent of its major product. Annual production of 30,000 subcomponents results in the following costs: Direct materials Direct labor Variable...

-

a. Explain how total portfolio risk can be decomposed into various risk exposures, and indicate why risk decomposition can be a complex exercise. b. Explain what is meant by the term risk budgeting.

-

Consider an induction stove utilizing a primary heating coil located just beneath the stove top. The circuit elements in the stove supply the coil with a peak ac voltage of 340 V at a frequency of 50...

-

Salary Offers You are applying for jobs at two companies. Company C offers starting salaries with = \($75,000\) and = \($2,500\). Company D offers starting salaries with = \($75,000\) and =...

-

Tadoussac Inc. and Sturgis Ltd. are plumbing supply companies operating in eastern Canada. Both companies are looking for investment to help with their expansion plans. You work for a small venture...

-

Suppose an investor is considering investing $X in a one-month portfolio consisting of ONE risk-free asset and ONE ACTUAL (not synthetic) risky asset. Suppose r f = 2%, E [ r r ] = 18%, and r = 3%....

-

According to the January theory, if the stock market is up at the end of January, it will be up for the year. If it is down at the end of January, it will be down for the year. Within the last 34...

-

Set up a spreadsheet that enables you to duplicate the calculations of section 21.5 of this chapter. A. B E 1 BOND CONVEXITY 2 Yield to maturity 6% 3 Bond 2 6.988% Bond 3 3.50% Bond 4 11.00% 4 Bond 1...

-

Stock price simulation: A stock?s price is lognormally distributed with mean ? = 15%. The current stock price is S 0 = 35. Following the template on the spreadsheet, create 60 static standard normal...

-

Church Company completes these transactions and events during March of the current year (terms for all its credit sales are 2/10, n/30). Mar. 1 Purchased $43,600 of merchandise from Van Industries,...

-

Garrett Automative Ltd (GAL) is a UK subsidiary of a American parent company that manufactures turbochargers for the automative industry. GAL decided to begin its profit improvement programme by...

-

According to a recent survey undertaken by CIMA, variable (or marginal) costing is used by almost 40 per cent of firms. Management accountants from a wide range of sectors, including manufacturing...

-

Operating leverage can tell investors a lot about a companys risk profile, and although high operating leverage can often benefit companies, firms with high operating leverage are also vulnerable to...

-

According to the International Air and Transport Association (IATA) conference airlines were expected to make around 3.18 profit from each passenger in 2014. Although carriers were expecting net...

-

The economic recession has resulted in original equipment manufacturers (OEMs) seeking to drive down costs by re-examining their manufacturing strategy, with many companies increasing their level of...

-

For the following independent cases, determine whether economic income is present and, if so, whether it must be included in gross income. Identify a tax authority that supports your analysis. a....

-

The Strahler Stream Order System ranks streams based on the number of tributaries that have merged. It is a top-down system where rivers of the first order are the headwaters (aka outermost...

-

List the factors that maintain an organization's culture.

-

Identify and describe the phases of organizational socialization.

-

How can culture be transmitted to employees? Provide examples for each.

-

2.1 Explain by means of drawings how the Successive-Approximation conversion process takes place when receiving an analog voltage input. Use the KEEP/RESET method. Use 5 V input. Vref= 8 V (10) 2.2...

-

Assume that we have a Ridge regression problem with only one predictor, and the true model is linear without an intercept, i.e. Y = X + e. Assume that we have In samples, (xi, y), (x2, Y2), . . .,...

-

Please write a program that calculates the final score of multiple students using different weight of exams and assign their final grade using the following criteria: If the average grade is 90 or...

Study smarter with the SolutionInn App