Which of Changs colleagues three statements is correct? A. Statement 1 B. Statement 2 C. Statement 3

Question:

Which of Chang’s colleague’s three statements is correct?

A. Statement 1 B. Statement 2 C. Statement 3 Jane Chang is an analyst at Alpha Fund covering the real estate and energy sectors. She and her colleague are analyzing two companies that are currently held by the fund.

The first company is Jupiter Corp., a publicly traded, national retail grocery store chain that has 2,800 physical stores. Jupiter leases most of its grocery stores and all five of its office locations that help the company achieve its core business of operating 50,000 square foot stores in all markets of the United States. Jupiter also owns the real estate (land and building)

associated with 100 physical store locations. Jupiter recently announced that its board of directors approved a strategic real estate plan to pursue a separation of all its owned assets.

The company currently has a speculative-grade credit rating.

The separation would be achieved through a series of sale-leaseback transactions with real estate investment trusts (REITs) that specialize in owning retail properties. Under the plan, Jupiter will sell its 100 owned grocery stores and lease them for 15-year terms with a combined annual rent expense of USD40 million. Jupiter expects to receive cash proceeds of approximately USD800 million from the property sales, which will be used to retire approximately USD600 million of debt and repurchase 4 million common shares.

Jupiter believes the pro forma capital structure following the transactions will enable it to receive an investment-grade credit rating. The sale-leaseback transactions value the 100 assets at an average capitalization rate of 5.50%. Based on Chang’s colleague’s research, the 25th, 50th, and 75th percentile cap rates for sale transactions for similarly situated properties and similar lease terms in the last three years were 5.00%, 5.50%, and 6.00%, respectively.

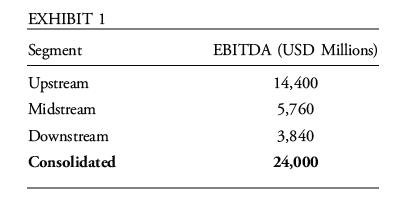

The second company is Saturn Corp., a publicly traded US energy company. Chang has been asked to assess the valuation of a potential spin off for this company. Saturn operates and reports three segments: Upstream, Midstream, and Downstream. In the last 12 months, the company reported the financial results shown in Exhibit 1.

Saturn is currently trading at an enterprise value of USD408,000 million, or an EV/

EBITDA multiple of 17. A spin off of the Downstream segment has long been rumored because it has been under-invested in by the current management team, resulting in slower revenue growth than its peers. Chang finds that the median Upstream, Midstream, and Downstream peers are trading at enterprise value-to-EBITDA multiples of 19, 17, and 13, respectively.

During an internal discussion, Chang’s colleague makes the following three statements about the comparable company analysis method:

Statement 1: The method is not sensitive to market mispricing.

Statement 2: The estimates of value are derived directly from the market.

Statement 3: The method provides a reasonable approximation of a target company’s value relative to similar transactions in the market.

Step by Step Answer:

Corporate Finance Workbook Economic Foundations And Financial Modeling

ISBN: 9781119743811

3rd Edition

Authors: CFA Institute, Michelle R. Clayman, Martin S. Fridson, George H. Troughton