1. Refer to the facts in Problem 10-16. Repeat the requirements assuming that Jake uses the FIFO...

Question:

1. Refer to the facts in Problem 10-16. Repeat the requirements assuming that Jake uses the FIFO cost flow assumption.

2. Explain how the financial statements are affected when a company decides that NRV should be used for the inventory value.

3. Repeat part 1 assuming that Jake has the same number of units for each inventory item and it applies lower of cost and NRV to total inventory instead of to each individual unit.

Problem 10-16

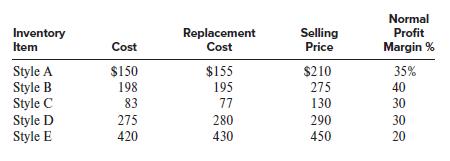

Ramps by Jake, Inc., manufactures skateboard ramps. The company uses independent sales representatives to market its products and pays a commission of 8% on each sale. Data regarding the five styles of ramps in the company’s inventory at December 31, 20X1, follow. The normal profit margin on each style is expressed as a percentage of the item’s selling price. Jake has multiple units of each style and uses the LIFO cost flow assumption.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer