At January 1, 20X1, Milo Co.s projected benefit obligation is $300,000, and the fair value of its

Question:

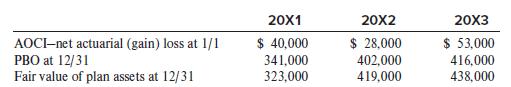

At January 1, 20X1, Milo Co.’s projected benefit obligation is $300,000, and the fair value of its pension plan assets is $340,000. The average remaining service period of Milo’s employees is 10 years. Milo Co. uses the calendar year for financial reporting. The following additional information is available for Milo’s net actuarial gains and losses:

Required:

Compute the amount of gain or loss amortization to be included in pension expense for each year, 20X1 through 20X3. Indicate whether the amortization increases or decreases pension expense.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

Question Posted: