Big Energy Corporation received regulatory approval for its 20X1 electricity rate. The company has been authorized to

Question:

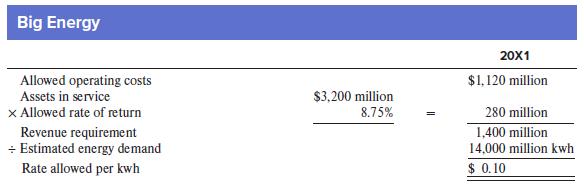

Big Energy Corporation received regulatory approval for its 20X1 electricity rate. The company has been authorized to charge customers $0.10 per kilowatt-hour (kwh), a rate lower than other utilities in the state charge. Details of the rate calculation follow:

Shortly after the 20X1 rate was set, the company’s financial reporting staff circulated an internal memo recommending that it appeal the ruling after making the following accounting changes:

1. Extend plant depreciation life by five years to reflect current utilization forecasts. This would add $175 million to the asset base and reduce annual depreciation (an operating cost) by $5 million.

2. Increase estimated bad debt expense from 1% to 1.5% of sales to reflect current forecasts of customer defaults. This would add $7 million to operating costs and reduce total assets by the same amount.

3. Amortize 20X0 hostile takeover defense costs of $4.5 million over three years rather than take the entire expense in 20X0. This action would increase 20X1 operating costs by $1.5 million and add $3 million to the asset base.

4. Write up fuel and materials inventories to their current replacement value. This action would add $60 million to the asset base, but it would have no impact on 20X1 operating costs.

Required:

1. Assess the impact of the proposed changes on the company’s 20X1 revenue requirement and rate per kilowatt-hour, assuming that regulators will approve the accounting changes and adjust the allowed rate accordingly.

2. As a member of the state utility commission, comment on the merits of each proposed accounting change.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer