Clovis Company recently issued $500,000 (face value) bonds to finance a new construction project. The companys chief

Question:

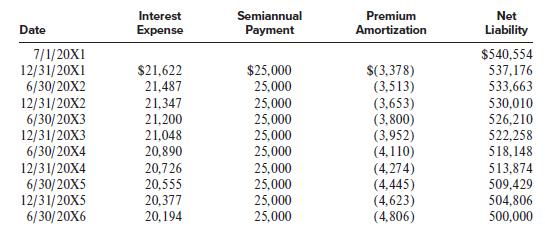

Clovis Company recently issued $500,000 (face value) bonds to finance a new construction project. The company’s chief accountant prepared the following bond amortization schedule:

Required:

1. Compute the discount or premium on the sale of the bonds, the semiannual coupon interest rate, and the semiannual effective interest rate.

2. The company’s vice president of finance wants any discount (or premium) at issuance of the bonds to be recorded immediately as a loss (or gain) at the issue date. Do you agree with this approach? Why or why not?

3. On December 31, 20X3, the bonds’ net carrying value is $522,258. In present value terms, what does this amount represent?

4. Suppose that market interest rates were 6% semiannually on January 1, 20X4, or 12.36% annually. [This 12.36% annual rate of interest is equal to the 6% semiannual rate, compounded: 0.1236 = (1.06 × 1.06) − 1.00.] What is the bond’s market price on that date? Is the company better or worse off because of the interest rate change? Explain.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer