Excerpts from IBMs 2012 segment disclosures are given below. Business Segments and Capabilities The companys major operations

Question:

Excerpts from IBM’s 2012 segment disclosures are given below.

Business Segments and Capabilities

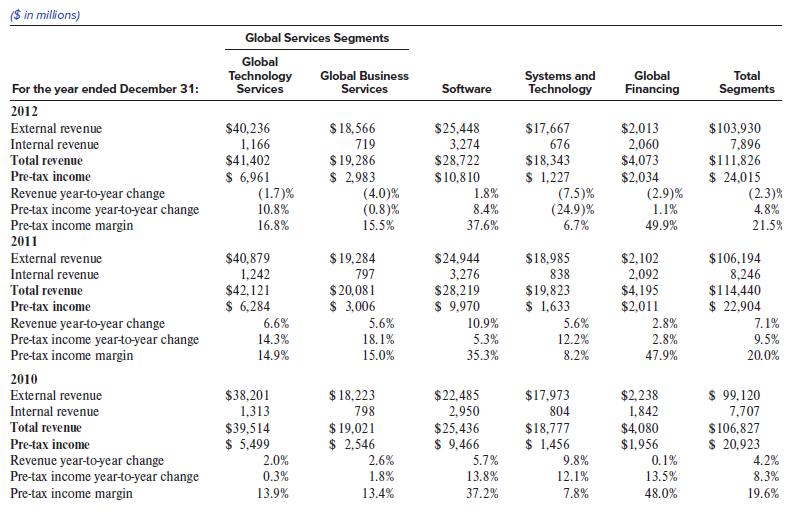

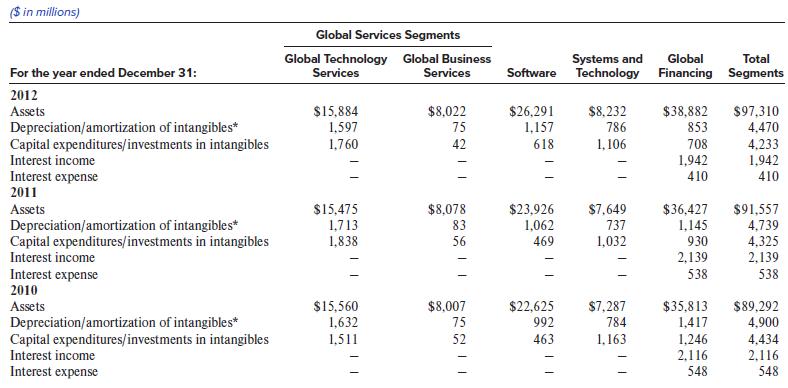

The company’s major operations consist of five business segments: Global Technology Services and Global Business Services, which the company collectively calls Global Services, Software, Systems and Technology and Global Financing. Global Technology Services (GTS) primarily provides IT infrastructure and business process services, creating business value for clients through unique technology and IP integrated services within its global delivery model. Global Business Services (GBS) has the mission to deliver predictable business outcomes to the company’s clients across two primary business areas: Consulting and Application Management Services. Software consists primarily of middleware and operating systems software. Systems and Technology (STG) provides clients with business solutions requiring advanced computing power and storage capabilities. Global Financing facilitates clients’ acquisition of IBM systems, software and services. Global Financing invests in financing assets, leverages with debt and manages the associated risks with the objective of generating consistently strong returns on equity.

The segments represent components of the company for which separate financial information is available that is utilized on a regular basis by the chief executive officer in determining how to allocate resources and evaluate performance. The segments are determined based on several factors, including client base, homogeneity of products, technology, delivery channels and similar economic characteristics. Segment revenue and pre-tax income include transactions between the segments that are intended to reflect an arm’s-length, market-based transfer price. The following tables reflect the results of operations of the company’s segments consistent with the management and measurement system utilized within the company. Performance measurement is based on pre-tax income. These results are used, in part, by senior management, both in evaluating the performance of, and in allocating resources to, each of the segments.

Major Clients

No single client represented 10 percent or more of the company’s total revenue in 2012, 2011, or 2010.

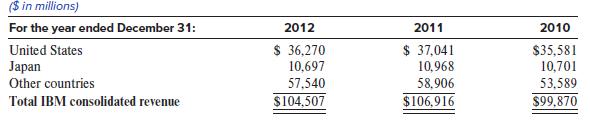

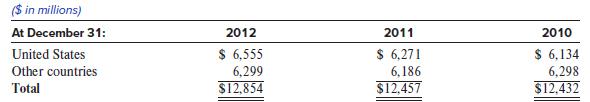

Geographic Information

The following provides information for those countries that are 10% or more of the specific category.

Revenue*

Plant and Other Property—Net

Required:

All questions relate to 2012 unless stated otherwise.

1. IBM refers to its segment reports as the “Management System Segment View.” What does IBM mean by this and how does it relate to the disclosure requirements under U.S. GAAP?

2. Which business segment contributes the most (least) external revenue for IBM? Compute the percentage of segment external revenue to total segments external revenue for these two segments.

3. Which business segment contributes the most (least) pre-tax income for IBM? Compute the percentage of segment pre-tax income to total segments pre-tax income for these two segments.

4. Which business segment had the highest (lowest) percentage growth (year-to-year change) in total revenue from 2011 to 2012? Show how the growth percentage was computed for the Software segment.

5. Which business segment had the highest (lowest) percentage growth (year-to-year change) in pre-tax income from 2011 to 2012?

6. Which segment had the highest (lowest) pre-tax income margin? Show how IBM computes the pre-tax income margin for these segments.

7. How would analysts use the business segment data related to the income statement?

8. Why would the Global Financing segment hold 40% ($38,882/$97,310) of the segment assets, but generate only 3.6% ($4,073/$111,826) of total segment revenue?

9. What percentage of IBM’s revenue is earned in the United States?

10. How would a stronger U.S. dollar affect IBM’s future reported revenue?

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer