lululemon athletica and Under Armour are both in the athletic apparel business. But the two companies depreciation

Question:

lululemon athletica and Under Armour are both in the athletic apparel business. But the two companies’ depreciation methods differ. The following explanations were excerpted from the two companies’ fiscal 2014 financial statements:

lululemon athletica

Property and Equipment Property and equipment are recorded at cost less accumulated depreciation.

Buildings are depreciated on a straight-line basis over the expected useful life of the asset, which we estimate to be 20 years. Leasehold improvements are depreciated on a straight-line basis over the lesser of the length of the lease and the estimated useful life of the assets, up to a maximum of five years. All other property and equipment is depreciated using the declining balance method as follows:

• Furniture and fixtures 20%

• Computer hardware and software 30%

• Equipment and vehicles 30%

Under Armour

Property and Equipment Property and equipment are stated at cost, including the cost of internal labor for software customized for internal use, less accumulated depreciation and amortization. Property and equipment is depreciated using the straight-line method over the estimated useful lives of the assets: 3 to 10 years for furniture, office equipment, software and plant equipment and 10 to 35 years for site improvements, buildings and building equipment. Leasehold and tenant improvements are amortized over the shorter of the lease term or the estimated useful lives of the assets. The cost of in-store apparel and footwear fixtures and displays are capitalized, included in furniture, fixtures and displays, and depreciated over 3 years. The Company periodically reviews assets’ estimated useful lives based upon actual experience and expected future utilization. A change in useful life is treated as a change in accounting estimate and is applied prospectively.

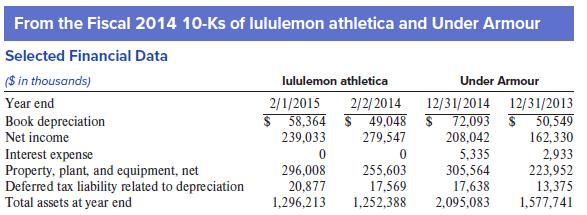

The following table provides selected financial statement data for the two companies.

Required:

1. Compute return on assets for fiscal 2014 for lululemon athletica and Under Armour. For lululemon athletica, fiscal 2014 refers to the year ended February 1, 2015.

2. Using the information provided and the analytical techniques illustrated in the chapter, determine each company’s tax depreciation for fiscal 2014.

3. Adjust each firm’s net income to reflect the same depreciation method and useful lives used for tax purposes.

4. Adjust each firm’s total assets to reflect the same depreciation method and useful lives used for tax purposes.

5. Compute return on assets for fiscal 2014 using the adjusted amounts. Discuss the differences between these results and the results from requirement 1.

6. Explain why the adjusted numbers provide a better basis for comparing the operating performance of the two companies.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer