Presented below are excerpts from the 2018 annual report of Marstons PLC, a UK-based company that operates

Question:

Presented below are excerpts from the 2018 annual report of Marston’s PLC, a UK-based company that operates pubs.

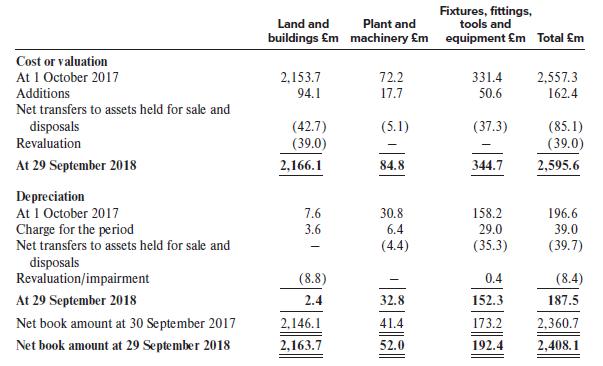

Property, plant and equipment

• Freehold and leasehold properties are initially stated at cost and subsequently at valuation. Plant and machinery and fixtures, fittings, tools and equipment are stated at cost.

• Depreciation is charged to the income statement on a straight-line basis to provide for the cost of the assets less their residual values over their useful lives.

• Freehold and long leasehold buildings are depreciated to their residual values over 50 years.

• Short leasehold properties are depreciated over the life of the lease.

• Plant and machinery and fixtures, fittings, tools and equipment are depreciated over periods ranging from 3 to 20 years.

• Own labour and interest costs directly attributable to capital projects are capitalised.

• Land is not depreciated.

Residual values and useful lives are reviewed and adjusted if appropriate at each balance sheet date. Properties are revalued by qualified valuers on a sufficiently regular basis using open market value so that the carrying value of an asset does not differ significantly from its fair value at the balance sheet date. Substantially all of the Group’s properties have been externally valued in accordance with the Royal Institution of Chartered Surveyors’ Red Book. These valuations are performed directly by reference to observable prices in an active market or recent market transactions on arm’s length terms. Internal valuations are performed on the same basis.

The estate is reviewed for indication of impairment at each reporting date, using a process focusing on areas of risk and business performance throughout the portfolio to identify any exposure. Impairment losses are charged to the revaluation reserve to the extent that a previous gain has been recorded, and thereafter to the income statement. Surpluses on revaluation are recognised in the revaluation reserve, except to the extent that they reverse previously charged impairment losses, in which case the reversal is recorded in the income statement.

Disposals of property, plant and equipment

Proft/loss on disposal of property, plant and equipment represents net sale proceeds less the carrying value of the assets. Any element of the revaluation reserve relating to the property disposed of is transferred to retained earnings at the date of sale.

Impairment

If there are indications of impairment or reversal of impairment, an assessment is made of the recoverable amount. An impairment loss is recognised where the recoverable amount is lower than the carrying value of assets, including goodwill. The recoverable amount is the higher of value in use and fair value less costs to sell.

Where there is an indication that any previously recognised impairment losses no longer exist or have decreased, a reversal of the loss is made if there has been a change in the estimates used to determine the recoverable amounts since the last impairment loss was recognised. The carrying amount of the asset is increased to its recoverable amount only up to the carrying amount that would have resulted, net of depreciation or amortisation, had no impairment loss been recognised for the asset in prior periods. The reversal is recognised in the income statement unless the asset is carried at a revalued amount. The reversal of an impairment loss on a revalued asset is recognised in other comprehensive income and increases the revaluation surplus for that asset. However, to the extent that an impairment loss on the same revalued asset was previously recognised in the income statement, the reversal of that impairment loss is recognised in the income statement. The depreciation charge is adjusted in future periods to allocate the asset’s revised carrying value, less any residual value, on a systematic basis over its remaining useful life. There is no reversal of impairment losses relating to goodwill. Acquired brands are reviewed for impairment on a portfolio basis.

12. Property, Plant and Equipment

Required:

Using the Marston’s excerpts, identify the similarities and differences between U.S. GAAP and IFRS regarding accounting for property, plant, and equipment.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer