The following information pertains P15-8 to the pension plan of Beatty Business Group: Note that the information

Question:

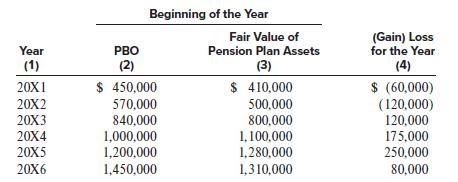

The following information pertains P15-8 to the pension plan of Beatty Business Group:

Note that the information in Columns (2) and (3) are as of the beginning of the year, whereas the information in Column (4) is measured over the year.

The AOCI—net actuarial (gain) loss at the end of 20X0 was $(70,000). The (gain) loss for the year account represents the excess of the realized return on pension plan assets over the expected return for the specific year. When a (gain) loss was reported, the realized return was (higher) lower than the expected return during that year. The estimated remaining service period of active employees is five years for each of the calendar years.

Required:

Provide a schedule showing how the (gain) loss is amortized over the 20X1–20X6 period. Clearly indicate whether the amortization increases or decreases the pension expense in each year.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer