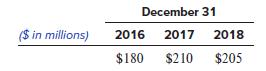

Trevathan Corporation has only one source of temporary differences warranties. At December 31, 2016, 2017, and 2018,

Question:

Trevathan Corporation has only one source of temporary differences warranties. At December 31, 2016, 2017, and 2018, the amounts of cumulative temporary differences were as follows:

Temporary differences related to warranties arise because warranty costs are expensed under U.S. GAAP in the same period as the related sales revenue is recognized, whereas no tax deduction is allowed until the warranty costs (e.g., for making required repairs) are actually paid, which generally happens in a later period. Trevathan had no other temporary differences, no net operating loss carryforwards, and no permanent differences. It had positive earnings before taxes under U.S. GAAP as well as positive taxable income in all years.

The corporate tax rate was 35% in 2017 and prior years, but was changed by the Tax Cuts and Jobs Act to 21% beginning in 2018. The new law was enacted in 2017.

Required:

1. Determine the amounts of Trevathan’s deferred tax asset or deferred tax liability at December 31, 2016, 2017, and 2018.

2. Determine the amount of Trevathan’s deferred income tax provision or benefit for 2017 and 2018.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer