An analyst is comparing the financial performance of Carpenter Technology Corporation (NYSE: CRS), a US company operating

Question:

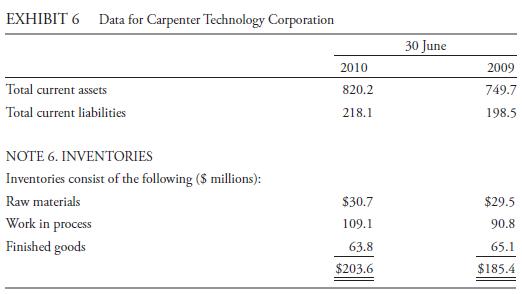

An analyst is comparing the financial performance of Carpenter Technology Corporation (NYSE: CRS), a US company operating in the specialty metals industry, with the financial performance of a similar company that uses IFRS for reporting. Under IFRS, this company uses the FIFO method of inventory accounting. Therefore, the analyst must convert results to a comparable basis. Exhibit 6 provides balance sheet information on CRS.

If the first-in, first-out method of inventory had been used instead of the LIFO method, inventories would have been $331.8 and $305.8 million higher as of June 30, 2010 and 2009, respectively.

1. Based on the information in Exhibit 6 , calculate CRS’s current ratio under FIFO and LIFO for 2009 and 2010.

2. CRS makes the following disclosure in the risk section of its MD&A. Assuming an effective tax rate of 35 percent, estimate the impact on CRS’s tax liability.

“We value most of our inventory using the LIFO method, which could be repealed resulting in adverse affects on our cash flows and financial condition.

The cost of our inventories is primarily determined using the Last-In First-Out (“LIFO”) method. Under the LIFO inventory valuation method, changes in the cost of raw materials and production activities are recognized in cost of sales in the current period even though these materials and other costs may have been incurred at significantly different values due to the length of time of our production cycle. Generally in a period of rising prices, LIFO recognizes higher costs of goods sold, which both reduces current income and assigns a lower value to the year-end inventory. Recent proposals have been initiated aimed at repealing the election to use the LIFO method for income tax purposes. According to these proposals, generally taxpayers that currently use the LIFO method would be required to revalue their LIFO inventory to its first-in, first-out (“FIFO”) value. As of June 30, 2010, if the FIFO method of inventory had been used instead of the LIFO method, our inventories would have been about $332 million higher. Th is increase in inventory would result in a one time increase in taxable income which would be taken into account ratably over the first taxable year and the following several taxable years. The repeal of LIFO could result in a substantial tax liability which could adversely impact our cash flows and financial condition.”

3. CRS reported cash flow from operations of $115.2 million for the year ended 30 June 2010. In comparison with the company’s operating cash flow, how significant is the additional potential tax liability?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie