Assume two identical (hypothetical) companies, CAP Inc. (CAP) and NOW Inc. (NOW), start with 1,000 cash and

Question:

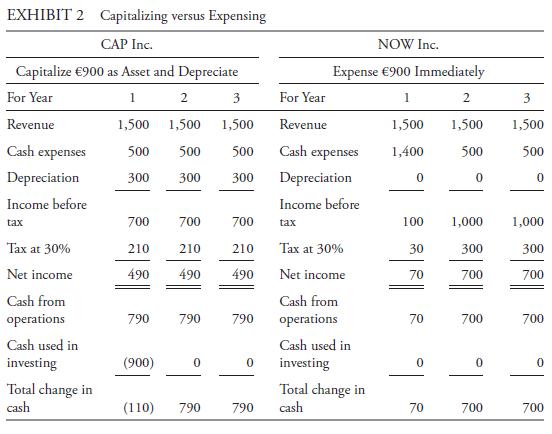

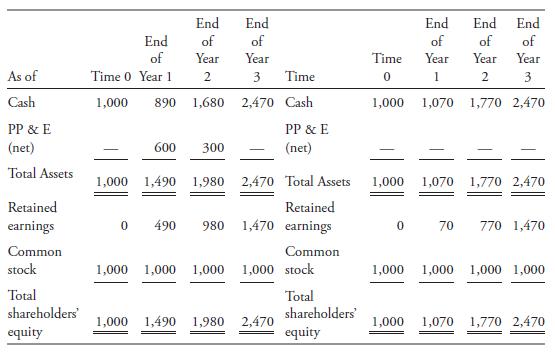

Assume two identical (hypothetical) companies, CAP Inc. (CAP) and NOW Inc. (NOW), start with €1,000 cash and €1,000 common stock. Each year the companies recognize total revenues of €1,500 cash and make cash expenditures, excluding an equipment purchase, of €500. At the beginning of operations, each company pays €900 to purchase equipment. CAP estimates the equipment will have a useful life of three years and an estimated salvage value of €0 at the end of the three years. NOW estimates a much shorter useful life and expenses the equipment immediately. The companies have no other assets and make no other asset purchases during the three year period. Assume the companies pay no dividends, earn zero interest on cash balances, have a tax rate of 30 percent, and use the same accounting method for financial and tax purposes.

The left side of Exhibit 2 shows CAP’s financial statements; that is, with the expenditure capitalized and depreciated at €300 per year based on the straight-line method of depreciation (€900 cost minus €0 salvage value equals €900, divided by a three-year life equals €300 per year). The right side of the exhibit shows NOW’s financial statements, with the entire €900 expenditure treated as an expense in the first year. All amounts are in euro.

1. Which company reports higher net income over the three years? Total cash flow?

Cash from operations?

2. Based on ROE and net profit margin, how does the profitability of the two companies compare?

3. Why does NOW report change in cash of €70 in Year 1, while CAP reports total change in cash of (€110)?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie