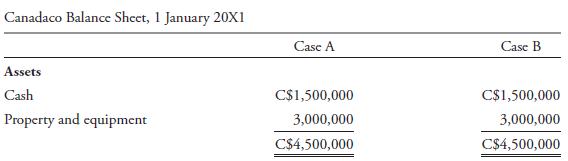

Canadaco begins operations on 1 January 20X1, with cash of C$1,500,000 and property and equipment of C$3,000,000.

Question:

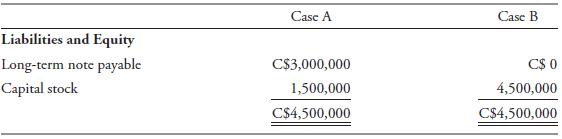

Canadaco begins operations on 1 January 20X1, with cash of C$1,500,000 and property and equipment of C$3,000,000. In Case A, Canadaco finances the acquisition of property and equipment with a long-term note payable and begins operations with net monetary liabilities of C$1,500,000 (C$3,000,000 long-term note payable less C$1,500,000 cash). In Case B, Canadaco finances the acquisition of property and equipment with capital stock and begins operations with net monetary assets of C$1,500,000. To isolate the effect that balance sheet exposure has on net income under the temporal method, assume that Canadaco continues to have C$270,000 in interest expense in Case B, even though there is no debt financing. This assumption is inconsistent with reality, but it allows us to more clearly see the effect of balance sheet exposure on net income. The only difference between Case A and Case B is the net monetary asset/liability position of the company, as shown in the following table:

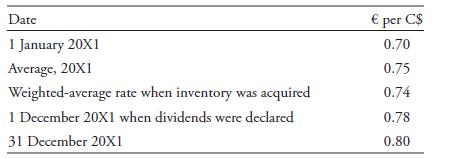

Canadaco purchases and sells inventory in 20X1, generating net income of C$1,180,000, out of which dividends of C$350,000 are paid. The company has total assets of C$5,780,000 as of 31 December 20X1. Canadaco’s functional currency is determined to be the euro (the parent’s presentation currency), and the company’s Canadian dollar financial statements are translated into euro using the temporal method.

Relevant exchange rates are as follows:

What effect does the nature of Canadaco’s net monetary asset or liability position have on the euro translated amounts?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie