If GSI (the company in Example 2) had used a perpetual inventory system, the timing of purchases

Question:

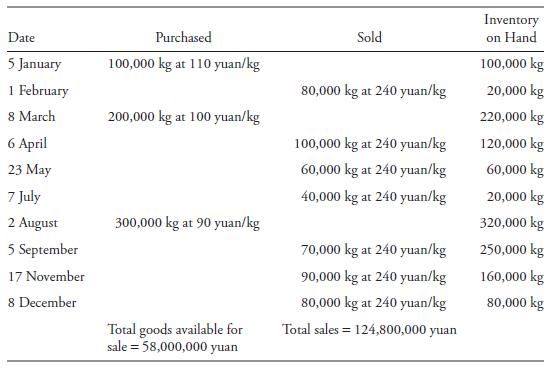

If GSI (the company in Example 2) had used a perpetual inventory system, the timing of purchases and sales would affect the amounts of cost of sales and inventory. Following is a record of the purchases, sales, and quantity of inventory on hand after the transaction in 2009.

The amounts for total goods available for sale and sales are the same under either the perpetual or periodic system in this first year of operation. The carrying amount of the ending inventory, however, may differ because the perpetual system will apply LIFO continuously throughout the year. Under the periodic system, it was assumed that the ending inventory was composed of 80,000 units of the oldest inventory, which cost 110 yuan/kg.

What are the ending inventory, cost of sales, and gross profit amounts using the perpetual system and the LIFO method? How do these compare with the amounts using the periodic system and the LIFO method, as in Example 2?

Data from Example 2

Global Sales, Inc. (GSI) is a hypothetical distributor of consumer products, including bars of violet essence soap. The soap is sold by the kilogram. GSI began operations in 2009, during which it purchased and received initially 100,000 kg of soap at 110 yuan/kg, then 200,000 kg of soap at 100 yuan/kg, and finally 300,000 kg of soap at 90 yuan/kg. GSI sold 520,000 kg of soap at 240 yuan/kg. GSI stores its soap in its warehouse so that soap from each shipment received is readily identifiable. During 2009, the entire 100,000 kg from the first shipment received, 180,000 kg of the second shipment received, and 240,000 kg of the final shipment received was sent to customers. Answers to the following questions should be rounded to the nearest 1,000 yuan.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie