If the accounting rules were to change, Silk Roads interest coverage ratio would be closest to: A.

Question:

If the accounting rules were to change, Silk Road’s interest coverage ratio would be closest to:

A. 3.03.

B. 3.50.

C. 5.04.

Sergei Leenid, CFA, is a long-only fixed income portfolio manager for the Parliament Funds. He has developed a quantitative model, based on financial statement data, to predict changes in the credit ratings assigned to corporate bond issues. Before applying the model, Leenid first performs a screening process to exclude bonds that fail to meet certain criteria relative to their credit rating. Existing holdings that fail to pass the initial screen are individually reviewed for potential disposition. Bonds that pass the screening process are evaluated using the quantitative model to identify potential rating changes.

Leenid is concerned that a pending change in accounting rules could affect the results of the initial screening process. One current screen excludes bonds when the financial leverage ratio (equity multiplier) exceeds a given level and/or the interest coverage ratio falls below a given level for a given bond rating. For example, any “A” rated bond of a company with a financial leverage ratio exceeding 2.0 or an interest coverage ratio below 6.0 would fail the initial screening. The failing bonds are eliminated from further analysis using the quantitative model.

The new accounting rule would require substantially all leases to be capitalized on a company’s balance sheets. To test whether the change in accounting rules will affect the output of the screening process, Leenid collects a random sample of “A” rated bonds issued by companies in the retail industry, which he believes will be among the industries most affected by the change.

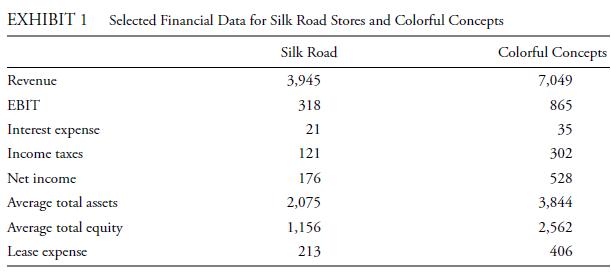

Two of the companies, Silk Road Stores and Colorful Concepts, recently issued bonds with similar terms and interest rates. Leenid decides to thoroughly analyze the potential effects of the change on these two companies and begins by gathering information from their most recent annual financial statements (Exhibit 1).

After examining lease disclosures, Leenid estimates the average lease term for each company at 8 years with a fairly consistent lease expense over that time. He believes the leases should be capitalized using 6.5 percent, the rate at which both companies recently issued bonds.

While examining the balance sheet for Colorful Concepts, Leenid also discovers that the company has a 204 ending asset balance (188 beginning) for investments in associates, primarily due to its 20 percent interest in the equity of Exotic Imports. Exotic Imports is a specialty retail chain and in the most recent year reported 1,230 in sales, 105 in net income, and had average total assets of 620.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie