In addition to disclosing assumptions about health care costs, companies also disclose information on the sensitivity of

Question:

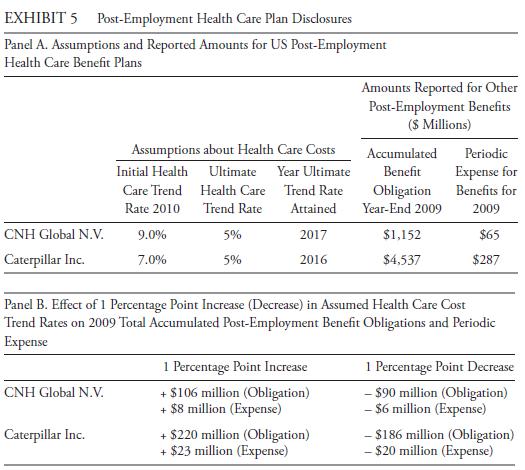

In addition to disclosing assumptions about health care costs, companies also disclose information on the sensitivity of the measurements of both the obligation and the periodic cost to changes in those assumptions. Exhibit 5 presents information obtained from the notes to the financial statements for CNH Global N.V. (a Dutch manufacturer of construction and mining equipment) and Caterpillar Inc. (a US manufacturer of construction and mining equipment, engines, and turbines). Each company has US employees for whom they provide post-employment health care benefits.

Panel A shows the companies’ assumptions about health care costs and the amounts each reported for post-employment health care benefit plans. For example, CNH assumes that the initial year’s (2010) increase in health care costs will be 9 percent, and this rate of increase will decline to 5 percent over the next seven years to 2017. Caterpillar assumes a lower initial-year increase of 7 percent and a decline to the ultimate health care trend rate of 5 percent in 2016.

Panel B shows the effect of a 100 basis point increase or decrease in the assumed health care cost trend rates. A 1 percentage point increase in the assumed health care cost trend rates would increase Caterpillar’s 2009 service and interest cost component of the other post-employment benefit costs by $23 million and the related obligation by $220 million. A 1 percentage point increase in the assumed health care cost trend rates would increase CNH Global’s 2009 service and interest cost component of the other post-employment benefit costs by $8 million and the related obligation by $106 million.

Based on the information in Exhibit 5 , answer the following questions:

1. Which company’s assumptions about health care costs appear less conservative?

2. What would be the effect of adjusting the post-employment benefit obligation and the periodic post-employment benefit expense of the less conservative company for a 1 percentage point increase in health care cost trend rates? Does this make the two companies more comparable?

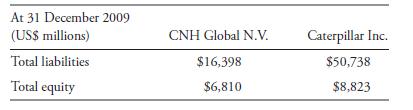

3. What would be the change in each company’s 2009 ratio of debt to equity assuming a 1 percentage point increase in the health care cost trend rate? Assume the change would have no impact on taxes. Total liabilities and total equity at 31 December 2009 are given below.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie