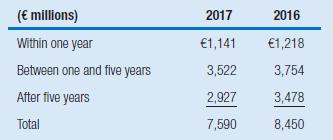

On December 31, 2017, Belgian-Dutch food retailer Ahold-Delhaize disclosed the following information about its operating lease commitments:

Question:

On December 31, 2017, Belgian-Dutch food retailer Ahold-Delhaize disclosed the following information about its operating lease commitments:

Ahold-Delhaize’s operating lease expense in 2017 amounted to €979 million and its statutory tax rate was 25 percent. Assume that Ahold-

Delhaize records its finance lease liabilities at an interest rate of 7.5 percent. Use this rate to capitalize Ahold-Delhaize’s operating leases at December 2016 and 2017.

a Record the adjustment to Ahold-Delhaize’s balance sheet at the end of 2016 to reflect the capitalization of operating leases.

b How would this reporting change affect Ahold-Delhaize’s income statement in 2017?

c When bringing operating lease commitments to the balance sheet, some analysts assume that in each year of the lease term, depreciation on the operating lease assets is exactly equal to the difference between

(a) the operating lease payment and

(b) the estimated interest expense on the operating lease obligation.

Explain how this simplifies the adjustments.

Do you consider this a valid assumption?

Step by Step Answer:

Business Analysis And Valuation

ISBN: 978-1473758421

5th Edition

Authors: Erik Peek, Paul Healy, Krishna Palepu