Referring to the data for Anson Industries and Clarence Corporation in Example 14 , which of the

Question:

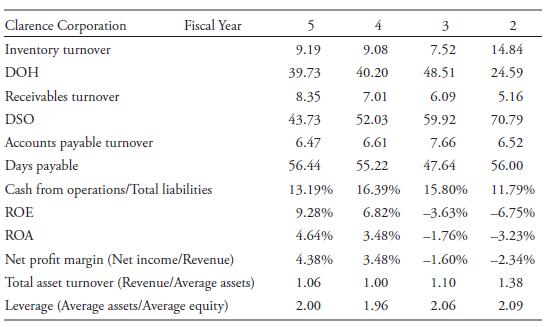

Referring to the data for Anson Industries and Clarence Corporation in Example 14 , which of the following choices best describes reasonable conclusions an analyst might make about the companies’ ROE?

A. Anson’s inventory turnover of 76.69 indicates it is more profitable than Clarence.

B. The main driver of Clarence’s superior ROE in FY5 is its more efficient use of assets.

C. The main drivers of Clarence’s superior ROE in FY5 are its greater use of debt financing and higher net profit margin.

Data from Example 14

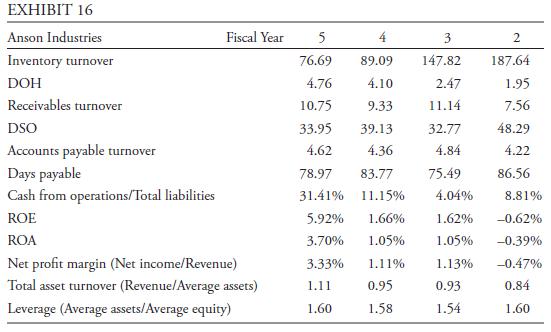

An analyst collects the information shown in Exhibit 16 for two companies:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie

Question Posted: