Selected excerpts from the consolidated financial statements and notes to consolidated financial statements for Alcatel-Lucent (NYSE: ALU)

Question:

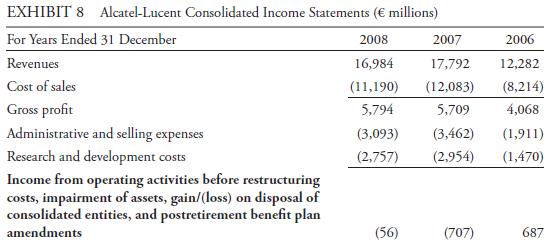

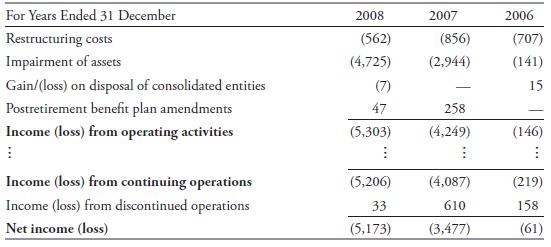

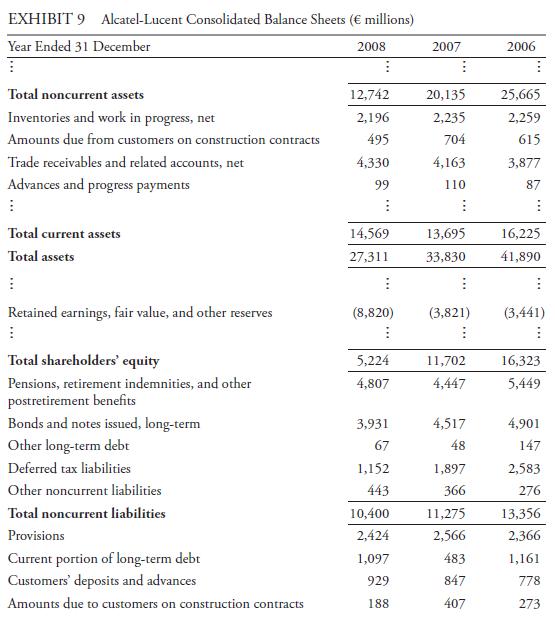

Selected excerpts from the consolidated financial statements and notes to consolidated financial statements for Alcatel-Lucent (NYSE: ALU) are presented in Exhibits 8, 9, and 10. Exhibit 8 contains excerpts from the consolidated income statements, and Exhibit 9 contains excerpts from the consolidated balance sheets. Exhibit 10 contains excerpts from three of the notes to consolidated financial statements.

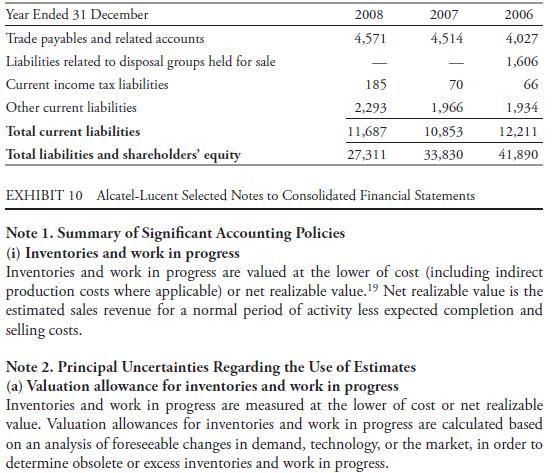

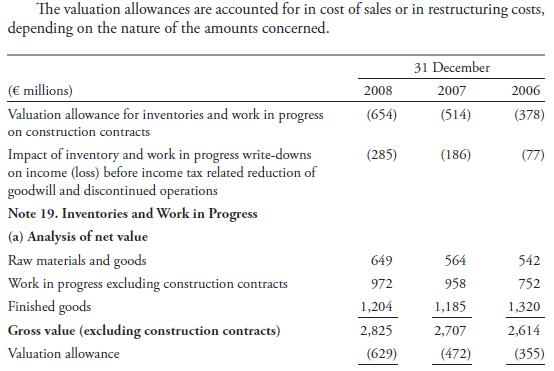

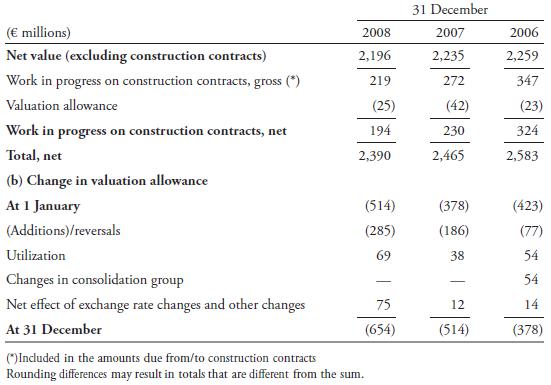

Note 1 (i) discloses that ALU’s finished goods inventories and work in progress are valued at the lower of cost or net realizable value. Note 2 (a) discloses that the impact of inventory and work in progress write-downs on ALU’s income before tax was a net reduction of €285 million in 2008, a net reduction of €186 million in 2007, and a net reduction of €77 million in 2006.18 The inventory impairment loss amounts steadily increased from 2006 to 2008 and are included as a component, (additions)/reversals, of ALU’s change in valuation allowance as disclosed in Note 19 (b) from Exhibit 10. Observe also that ALU discloses its valuation allowance at 31 December 2008, 2007, and 2006 in Note 19(b) and details on the allocation of the allowance are included in Note 19 (a). The €654 million valuation allowance is the total of a €629 million allowance for inventories and a €25 million allowance for work in progress on construction contracts.

Finally, observe that the €2,196 million net value for inventories (excluding construction contracts) at 31 December 2008 in Note 19 (a) reconciles with the balance sheet amount for inventories and work in progress, net, on 31 December 2008, as presented in Exhibit 9.

The inventory valuation allowance represents the total amount of inventory write downs taken for the inventory reported on the balance sheet (which is measured at the lower of cost or net realizable value). Therefore, an analyst can determine the historical cost of the company’s inventory by adding the inventory valuation allowance to the reported inventory carrying amount on the balance sheet. The valuation allowance increased in magnitude and as a percentage of gross inventory values from 2006 to 2008.

1. Calculate ALU’s inventory turnover, number of days of inventory on hand, gross profit margin, current ratio, debt-to-equity ratio, and return on total assets for 2008 and 2007 based on the numbers reported. Use an average for inventory and total asset amounts and year-end numbers for other ratio items. For debt, include only bonds and notes issued, long-term; other long-term debt; and current portion of long-term debt.

2. Based on the answer to Question 1, comment on the changes from 2007 to 2008.

3. If ALU had used the weighted average cost method instead of the FIFO method during 2008, 2007, and 2006, what would be the effect on ALU’s reported cost of sales and inventory carrying amounts? What would be the directional impact on the financial ratios that were calculated for ALU in Question 1?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie