The following are excerpts of pension-related disclosures from Novo Nordisks (NYSE: NVO) 2010 Annual Report. NOVO Nordisk

Question:

The following are excerpts of pension-related disclosures from Novo Nordisk’s (NYSE: NVO) 2010 Annual Report. NOVO Nordisk reports under IFRS. These financial statements were issued prior to the updated IFRS for pension accounting, which (effective January 2013) requires companies to show the entire amount of net liability or asset on the balance sheet and to recognise the entire change in that amount each period.

1. Summary of significant accounting policies Pensions The Group operates a number of defined contribution plans throughout the world. In a few countries the group still operates defined benefit plans. The costs for the year for defined benefit plans are determined using the projected unit credit method. This reflects services rendered by employees to the dates of valuation and is based on actuarial assumptions primarily regarding discount rates used in determining the present value of benefits, projected rates of remuneration growth and long-term expected rates of return for plan assets. Discount rates are based on the market yields of high-rated corporate bonds in the country concerned.

Use information in the excerpts to answer the following questions:

1. What type(s) of pension plans does Novo Nordisk have?

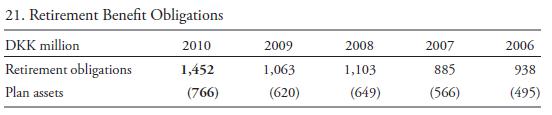

2. Under the updated standards, what would have been reported on Novo Nordisk’s 2009 and 2010 balance sheets with respect to pensions?

3. Under the updated standards, what amount of pension costs would Novo Nordisk have recognised in 2010? Describe how these costs would have been reported.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie