The following is an excerpt from Note 13 (Pensions and Other Post-Employment Benefits) to the 2020 Consolidated

Question:

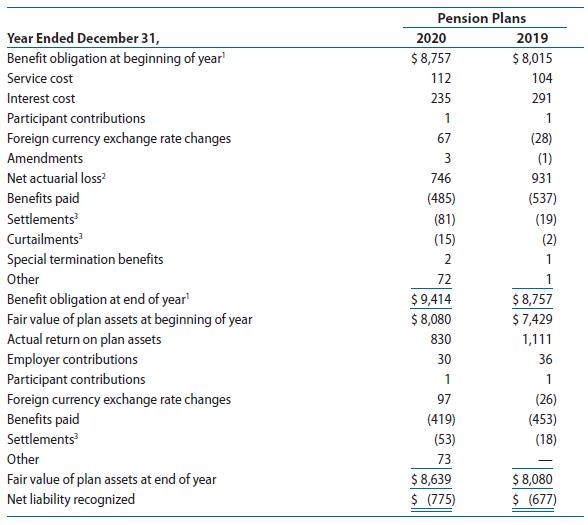

The following is an excerpt from Note 13 (Pensions and Other Post-Employment Benefits) to the 2020 Consolidated Financial Statements of Coca-Cola Company (Coca-Cola):

*Some pension plans are “unfunded,” meaning that the company does not hire an independent trustee and send the funds to the trustee for investment but, instead, pays retirees out of company rather than trustee pension fund assets. Coca-Cola paid $44 million out of company assets to retirees covered by unfunded plans.

Source: The Coca-Cola Company, Form 10-K for the Fiscal Year ended December 31, 2020.

REQUIRED

a. Write a memorandum explaining the change in the net pension liability in 2020. (Do not assume that the reader knows what items such as “service cost” mean.)

b. For each item in the 2020 reconciliation, explain whether the effect on the PBO and the fair value of plan assets is reflected in current period pension expense or as a change in other comprehensive income.

c. Provide a general justification for keeping some PBO and fair value of plan asset changes out of current period net income.

Step by Step Answer:

Financial Reporting Financial Statement Analysis And Valuation

ISBN: 9780357722091

10th Edition

Authors: James M Wahlen, Stephen P Baginskl, Mark T Bradshaw