What is the least likely reason why ZP may need to change its accounting policies regarding inventory

Question:

What is the least likely reason why ZP may need to change its accounting policies regarding inventory at some point after 2009?

A. The U.S. SEC is likely to require companies to use the same inventory valuation method for all inventories.

B. The U.S. SEC is likely to prohibit the use of one of the methods ZP currently uses for inventory valuation.

C. One of the inventory valuation methods used for U.S. tax purposes may be repealed as an acceptable method.

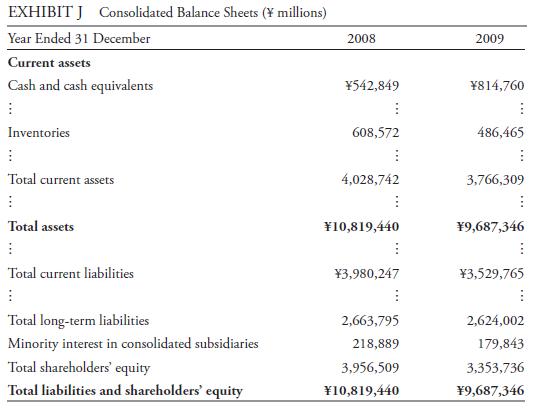

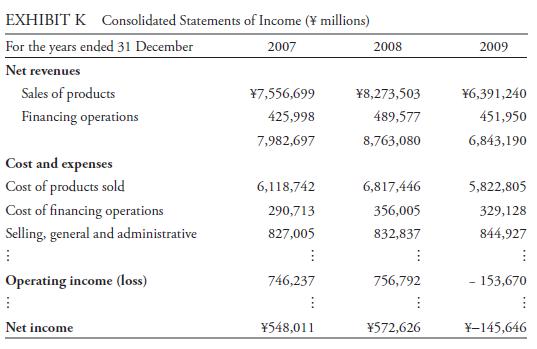

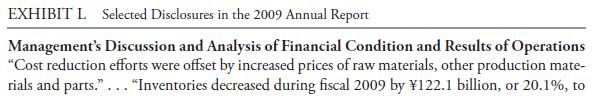

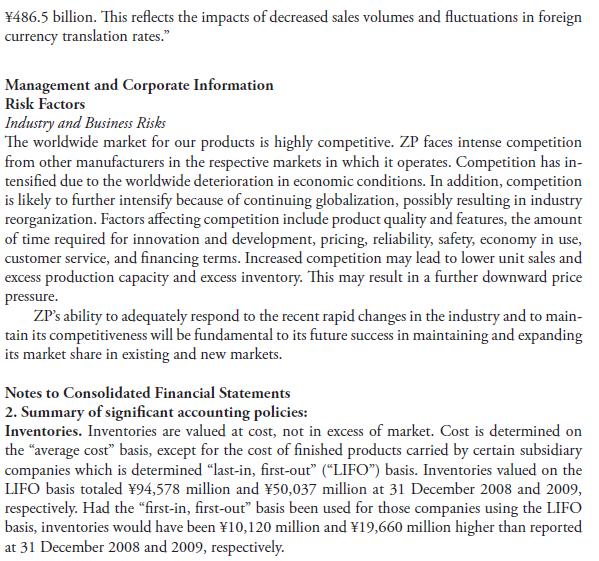

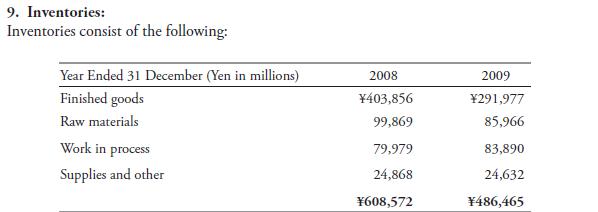

ZP Corporation is a (hypothetical) multinational corporation headquartered in Japan that trades on numerous stock exchanges. ZP prepares its consolidated financial statements in accordance with U.S. GAAP. Excerpts from ZP’s 2009 annual report are shown in Exhibits J−L.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie