A sales-based ranking of software companies provided by Yahoo! Finance on November 5, 2008, places Oracle Corporation

Question:

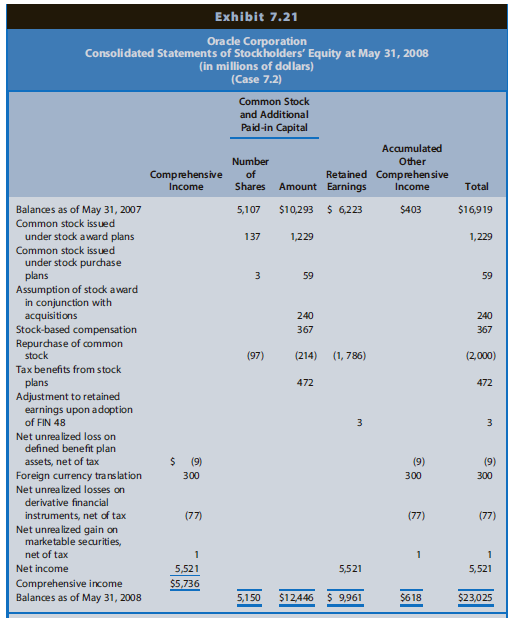

As indicated by the selected data from Oracle's May 31, 2008, consolidated balance sheet in Exhibit 7.20, Oracle finances operations using substantially more common shareholder's equity than it does long-term debt. However, Oracle's long-term debt to shareholders' equity ratio of 44.5% is substantially larger than that of major U.S. competitor Microsoft Corporation and major foreign competitor SAP AG, both of which report almost no long-term financial debt. Exhibit 7.21 presents the consolidated statement of shareholders' equity for 2008. Exhibit 7.22 presents portions of financial statement Notes 10 and 11.

REQUIRED

a. Compute Oracle's long-term debt to shareholders' equity ratio for May 31, 2008 and 2007. Identify the increases in shareholders' equity in 2008 from share-based compensation plans. Calculate the long-term debt to shareholders' equity ratio that would have occurred had Oracle not implemented the stock repurchase plan. Comment on the potential effect on future ROE of Oracle's financing strategy.

b. Retained earnings increase because of net income and decrease because of dividends declared. Why, then, did Oracle decrease retained earnings when it repurchased common stock?

c. Of the first five changes listed in the shareholders' equity section, one of them, the common stock repurchase, clearly represents a cash outflow. Identify the cash flow effects of the other four items. Where will each cash flow effect be reported in the statement of cash flows?

d. Oracle engages in many transactions with nonowners (that is, customers, suppliers, and the government) that increase net assets. For example, Oracle's foreign subsidiaries perform services on credit with unrelated third-party customers. The accounts receivable generated by the transactions are denominated in a foreign currency and thus are reported on the foreign subsidiaries' balance sheet in that foreign currency. The consolidation process causes the subsidiary's accounts receivable to be added to the parent company's (Oracle's) accounts receivable and reported on Oracle's Consolidated Balance Sheet. Assuming that the foreign currency strengthens relative to the U.S. dollar, how does Oracle's Consolidated Statement of Shareholders' Equity capture the increases in accounts receivable described in this example transaction?

e. Using the foreign currency translation gain of $300 million as a context, present an argument for including the gain on Oracle€™s income statement and an argument for excluding the gain as Oracle does under U.S. GAAP.

f. Under Oracle€™s Employee Stock Purchase Plan, employees can purchase common shares at 95% of their fair values. Will Oracle report a loss on this transaction? Why or why not?

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Financial Reporting Financial Statement Analysis and Valuation a strategic perspective

ISBN: 978-1337614689

9th edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw